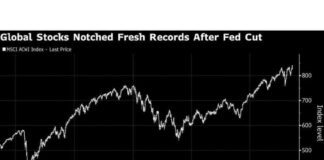

Wall Street has wrapped up its best week since November, with U.S. stocks edging higher on Friday. The S&P 500 rose 0.2% for a seventh consecutive gain, bringing it within 2% of its all-time high set last month. The Dow Jones Industrial Average also gained 0.2%, and the Nasdaq composite added 0.2% to cap off a positive week for the markets.

### Strong Performance for the Week

For the week, the S&P 500 saw a significant increase of nearly 3.9%, marking its best performance since November 2023. The Nasdaq gained 5.2%, while the Dow rose 2.9%, reflecting the overall positive sentiment in the market. This strong performance comes after a period of volatility and uncertainty that had gripped Wall Street in recent weeks.

### Economic Indicators and Market Sentiment

Throughout the week, Treasury yields fluctuated in response to mixed reports on the U.S. economy. One report indicated that homebuilders had started fewer projects than expected, which initially dampened market optimism. However, this was offset by a series of better-than-expected reports on inflation and retail sales, which buoyed investor confidence.

A key highlight was a report showing that U.S. consumers are feeling more positive about the economy than anticipated. Consumer spending plays a crucial role in driving economic growth, so this uptick in sentiment was seen as a positive sign for the overall health of the economy.

### Federal Reserve Policy and Interest Rates

The recent economic data and market performance have raised questions about the Federal Reserve’s stance on interest rates. The Fed has been gradually raising rates to cool down what was a robust job market and prevent runaway inflation. However, concerns remain about whether the economy’s growth will slow down too much and potentially lead to a recession.

Market observers are closely watching for any hints from Federal Reserve Chair Jerome Powell, who is expected to give a speech at the upcoming Jackson Hole symposium. Powell’s comments could provide insights into the Fed’s future policy direction and whether further rate cuts are on the horizon to support economic growth.

### Tech Sector and Global Market Trends

Another focal point for investors has been the valuation of tech stocks, particularly highly influential companies like Nvidia. The AI craze has propelled these stocks to new heights, but concerns linger about whether prices have become too inflated. Nvidia’s stock experienced significant volatility during the week, underscoring the uncertainty surrounding tech valuations.

Global markets have also been impacted by technical factors, such as the Bank of Japan’s interest rate hike. The move triggered widespread selling by hedge funds engaged in a popular trading strategy, leading to market turmoil. While the situation has stabilized, analysts warn that there could be further selling pressure if market conditions remain unstable.

### Company Performance and Market Outlook

Amidst the market fluctuations, some companies have stood out for their strong performance. H&R Block, for instance, saw a notable increase of 12.1% after reporting better-than-expected profits and announcing a dividend increase and stock buyback program. Such positive developments highlight the resilience of certain companies in the face of market volatility.

Looking ahead, investors will continue to monitor economic indicators, Federal Reserve policy decisions, and global market trends for clues about the market direction. The upcoming Jackson Hole symposium and potential rate cuts by the Fed are expected to influence market sentiment in the coming weeks.

In conclusion, the recent market rally and positive economic data have provided some respite for investors after a period of uncertainty. While challenges and concerns persist, the overall outlook remains cautiously optimistic as Wall Street navigates through volatile market conditions.