**Asian Stock Markets Anticipate Decline Amid Rising China Concerns**

Asian stock markets are bracing for a potential decline early this week as worries about the Chinese economy continue to escalate. US equity futures are holding steady, but contracts in Australia, Hong Kong, and mainland China are indicating a possible early loss at the start of the trading week. With Japanese markets closed for a holiday, trading in Asia may see increased volatility due to thin liquidity.

The S&P 500 closed 0.2% lower on Friday following a quarterly options expiry, setting the stage for a potentially rocky start to the week. Concerns about China’s economic health have been mounting, with recent data showing a decrease in government spending and a rise in the youth jobless rate. Additionally, reports suggest that the US is considering rules that would ban Chinese hardware and software for connected vehicles as early as Monday.

Analyst Tony Sycamore from IG in Sydney commented, “Things in China are going from bad to worse. With Japanese stock markets closed for a public holiday, the PBOC disappointing the market on Friday, and US yields ratcheting higher, we are likely to see a more downbeat tone across Asian equity markets today.”

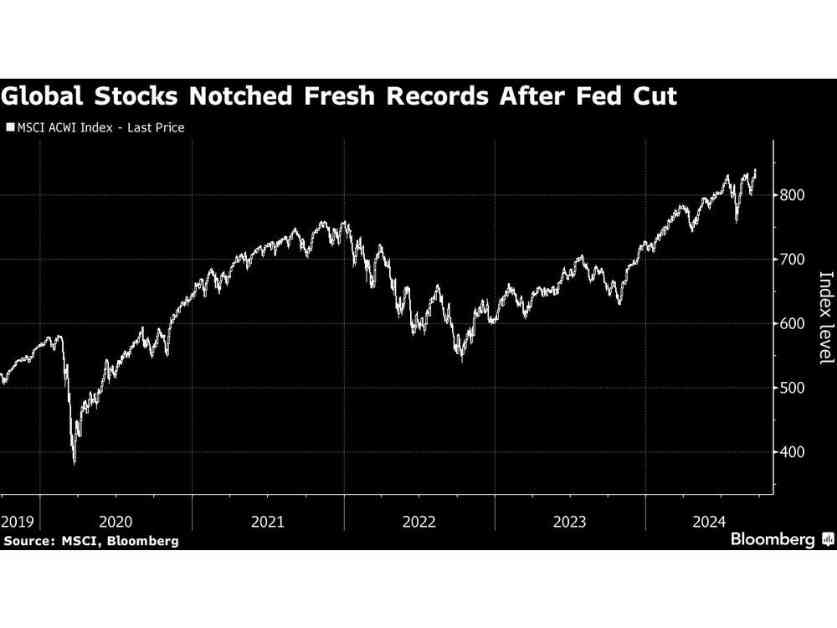

As markets gear up for the final quarter of the year, investors are closely watching for developments following the Federal Reserve’s recent rate cut. Data releases this week, including the Fed’s preferred measure of inflation, will provide further insight into the direction of the markets. A deterioration in economic indicators could increase the likelihood of another rate cut by the Fed.

In US trading on Friday, the S&P 500 and Nasdaq 100 both closed lower, with the Dow Jones Industrial Average reaching a new record high. Intel Corp. saw gains following reports of a bid by Qualcomm Inc., while gold prices surged above $2,600 an ounce after geopolitical tensions in the Middle East.

Looking ahead, key events this week include factory activity and consumer confidence readings in Europe, inflation data releases in Australia and Tokyo, and a slew of Fed speakers discussing economic data and policy decisions. Market participants will be closely monitoring these events for potential market-moving developments.

**Market Movements and Outlook:**

**Stocks:**

– S&P 500 futures remained steady, with Hang Seng and S&P/ASX 200 futures indicating potential declines.

**Currencies:**

– The Bloomberg Dollar Spot Index held steady, with major currencies showing minimal movement.

**Cryptocurrencies:**

– Bitcoin and Ether saw slight gains in early trading.

**Bonds:**

– Australia’s 10-year yield rose slightly to 3.95%.

**Commodities:**

– Crude oil and gold prices remained stable in early trading.

As global markets navigate economic uncertainties and geopolitical tensions, investors are advised to closely monitor key economic indicators and events that could impact market sentiment in the coming days. Keeping a close eye on developments in China, the US, and other major economies will be crucial for making informed investment decisions in the current market environment.