Navigating China’s Steel Industry Crisis: Understanding the Wave of Bankruptcies

China’s steel industry is currently facing a major crisis that is leading to a wave of bankruptcies and a much-needed consolidation of the sector. According to Bloomberg Intelligence, almost three-quarters of the country’s steelmakers experienced losses in the first half of the year, indicating a dire situation that could result in bankruptcy for many of them.

The Steel Industry Landscape in China

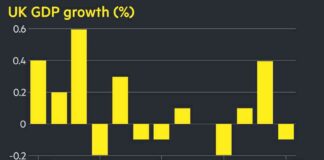

The steel industry in China has been hit hard by a combination of factors, including a persistent property crisis and sluggish economic growth. As a result, the industry is undergoing a significant transformation, with the government pushing for more consolidation to create a more efficient and competitive market.

Bloomberg Intelligence analyst Michelle Leung highlights that certain steelmakers, such as Xinjiang Ba Yi Iron & Steel Co., Gansu Jiu Steel Group, and Anyang Iron & Steel Group Co., are at high risk of bankruptcy and could potentially become acquisition targets. This wave of bankruptcies and acquisitions is seen as a necessary step towards restructuring the industry and ensuring its long-term viability.

Government Targets and Industry Outlook

In line with its efforts to consolidate the steel industry, the Chinese government has set ambitious targets for market concentration. By 2025, the top five companies are expected to control 40% of the market, with the top 10 accounting for 60%. While these targets are considered achievable, China still lags behind countries like South Korea and Japan in terms of industry concentration.

The current challenges facing the steel industry in China are also reflected in its export activities. As domestic demand remains weak, Chinese mills have increased their exports, leading to accusations of dumping from trading partners. Despite this backlash, China’s steel exports are not expected to decline until the end of 2026, as production levels fall and more countries impose restrictions on Chinese steel imports.

Implications for the Economy and Global Trade

The ongoing crisis in China’s steel industry has broader implications for the country’s economy and global trade. The head of China Baowu Steel Group Corp. has warned of a crisis worse than those experienced in 2008 and 2015, highlighting the severity of the situation. The industry’s struggles have also prompted concerns about the impact on consumption and the need for further stimulus measures, such as mortgage rate cuts.

In addition, China’s steel exports are likely to face continued scrutiny from trading partners as production levels remain high and global demand weakens. This could lead to increased trade tensions and further challenges for the industry in the coming years.

The Way Forward

As China grapples with the challenges facing its steel industry, there are several key events and developments to watch in the coming days and weeks. These include industry conferences, quality standards for steel products, and economic data releases that will provide insights into the industry’s performance and prospects for the future.

In conclusion, the crisis facing China’s steel industry is a complex and multifaceted issue that requires careful navigation and strategic planning. By addressing the root causes of the crisis and implementing targeted measures to support the industry, China can work towards a more sustainable and competitive steel sector that will benefit both the economy and global trade.