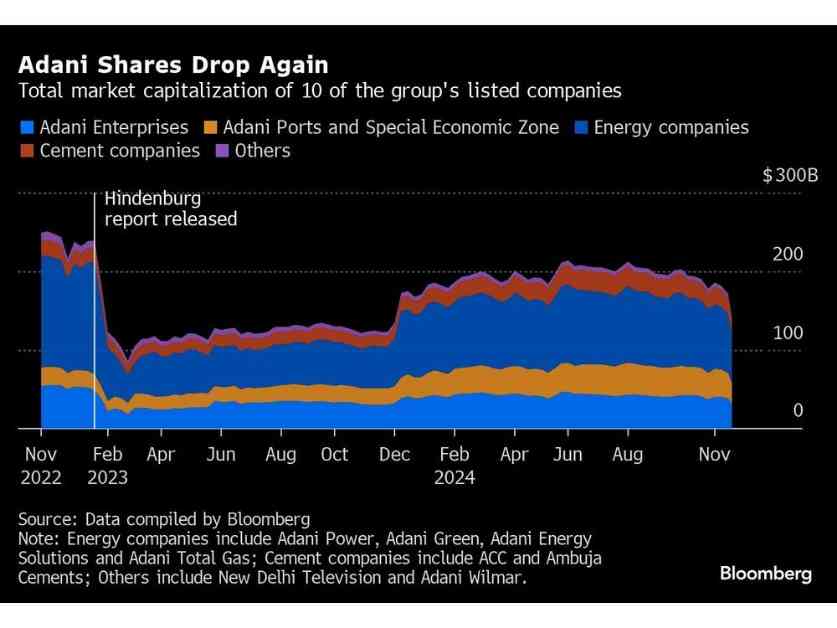

Investors in India are facing challenges as the Adani Group comes under investigation, impacting green energy stocks in the country. The conglomerate’s troubles are causing concern among investors, with fears that those holding Adani shares may sell off other profitable positions to make up for losses, leading to market declines.

The bribery charges against the Adani Group are further complicating the situation for investors in India. This negative news is adding to existing challenges in the market, such as high valuations and slowing earnings growth, making foreign investors hesitant to put their money into Indian equities. Since October, foreign investors have pulled out a significant amount of money from Indian stocks.

The green energy sector is particularly feeling the impact of the Adani probe, with stocks of renewable energy producers and equipment makers taking a hit. The indictment of Gautam Adani in the US for alleged bribery has raised concerns about the sector’s practices in winning contracts from the Indian solar energy body. This has led to a decline in stock prices for companies like NTPC and Waaree Energies.

On the housing front, there are mixed signals for the market. While housing sales are strong, the impact is varied across different sectors. Pipe makers are benefiting from demand in agriculture, housing, and infrastructure, while wood panel makers are facing challenges due to high timber costs. Tile makers, on the other hand, are struggling with weak export demand, leading to an oversupply in the domestic market.

Overall, the situation in the Indian market is uncertain, with investors wary of the risks posed by the Adani Group’s troubles. The impact of the probe on green energy stocks and the mixed trends in the housing sector are adding to the complexity of the investment landscape in India. It remains to be seen how the market will navigate these challenges in the coming days and weeks.