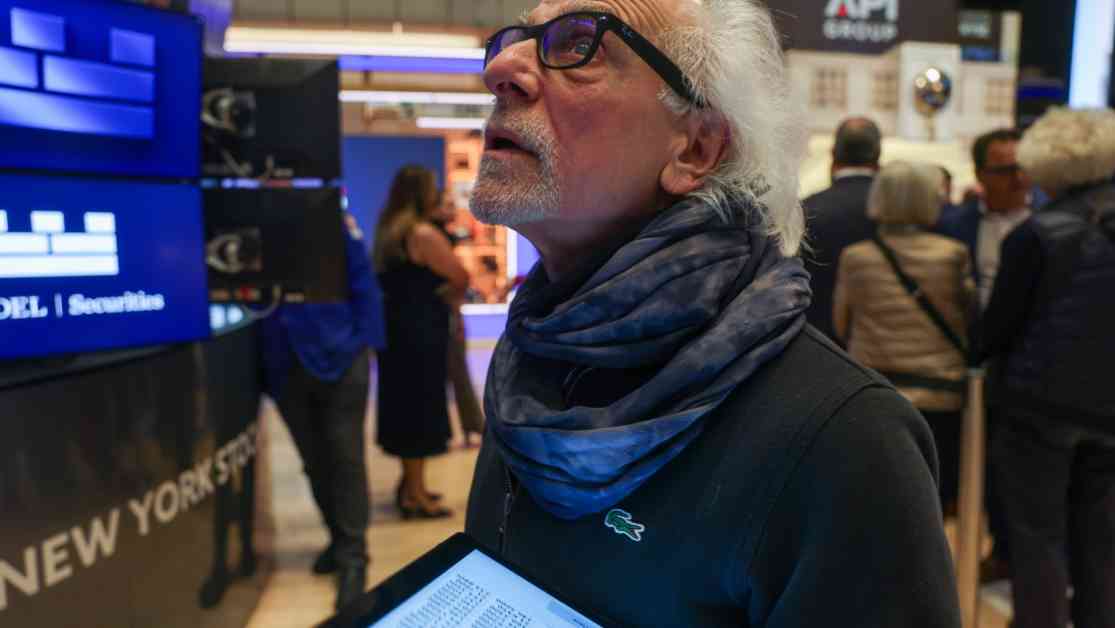

Wall Street is having quite the rollercoaster ride this week, with investors feeling a bit queasy about the United States’ position in the global market. The ongoing drama surrounding tariffs is leaving everyone on edge, wondering what the future holds for the economy. Bonds from the U.S. government are being dumped like yesterday’s leftovers in what’s being called the “Sell America” trade. This is causing the government to shell out more money to borrow, which is never a good sign.

The Treasury department recently held an auction for $20 billion worth of bonds, but the demand was lukewarm at best. As a result, the interest rates on these bonds ended up higher than expected. This has sent shockwaves through the markets, with yields on 30-year U.S. Treasuries soaring above 5% — a pretty big deal considering how stable these investments are supposed to be. The increase in bond yields is bad news for consumers, as it means higher interest rates on things like mortgages and loans.

The European Central Bank has also chimed in on the situation, warning that President Trump’s tariff tactics are putting the global financial system in jeopardy. Moody’s, a credit rating agency, recently downgraded the creditworthiness of the United States due to its mounting national deficit, which is inching closer to $2 trillion. The agency also took a jab at Trump’s budget bill and tax cuts, suggesting that these policies will only worsen the deficit in the long run. All these factors combined are painting a rather grim picture of the U.S. economy in the eyes of investors, businesses, and consumers alike.

Not really sure why this matters, but the “sell America” trade represents a shift in how people view the U.S. economy. The once-stable reputation of the U.S. as an economic powerhouse seems to be fading, with investors now hesitating to park their cash in American assets. The general consensus seems to be that the U.S. is not as safe of a bet as it used to be, which is definitely causing some concern in the financial world. Maybe it’s just me, but it feels like we’re in for a bumpy ride ahead.