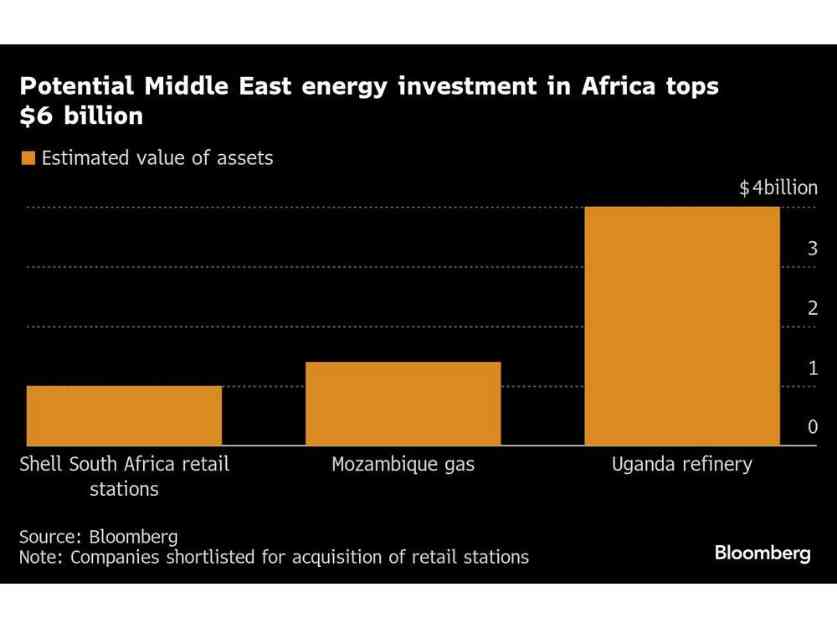

Middle East countries have been eyeing or sealing deals for approximately $6 billion worth of African energy assets in recent weeks. This demonstrates a growing interest in investing in the continent by the region.

Abu Dhabi National Oil Co. is in the running to purchase Shell Plc’s downstream assets in South Africa, valued at around $1 billion. Adnoc and other companies from the UAE have shown interest in various sectors of Africa’s energy industry in a short period of time.

Gulf states have been increasing their investments in energy projects across Africa, including renewable energy plants and oil fields. Bilateral trade between Africa and the UAE has seen a 38% increase over the past two years, reaching $86 billion, according to a report from the African Export-Import Bank.

The UAE and other Gulf nations are expanding their oil and gas industries by investing in assets and projects outside their home countries. This strategy helps them navigate market fluctuations and cyclical trends. Africa presents significant opportunities for such investments.

Alpha MBM Investments LLC, based in Dubai and led by a member of the Dubai royal family, has signed an agreement with Uganda to construct a refinery with a capacity of 60,000 barrels per day. The company will hold a 60% stake in the business. This deal, valued at $4 billion, comes after several unsuccessful attempts to build a refinery in Uganda.

The deal with Alpha MBM Investments LLC is seen as a positive development for governments as it allows them to partner with companies that are already rich in resources, shifting the focus from resource extraction to serving their domestic economies.

Kenya has extended a contract to purchase fuel on credit for an additional two years from Adnoc, Saudi Aramco, and Emirates National Oil Co. This arrangement has helped stabilize the country’s currency. Some of the imported fuel is further distributed to markets in South Sudan, the Democratic Republic of Congo, and Burundi.

Overall, Middle East countries are showing a keen interest in African energy assets, with investments totaling billions of dollars in recent weeks. This trend highlights the growing investment appetite in Africa by countries in the Middle East.