Korea Inflation Remains Stable with Lower-Than-Expected Increase

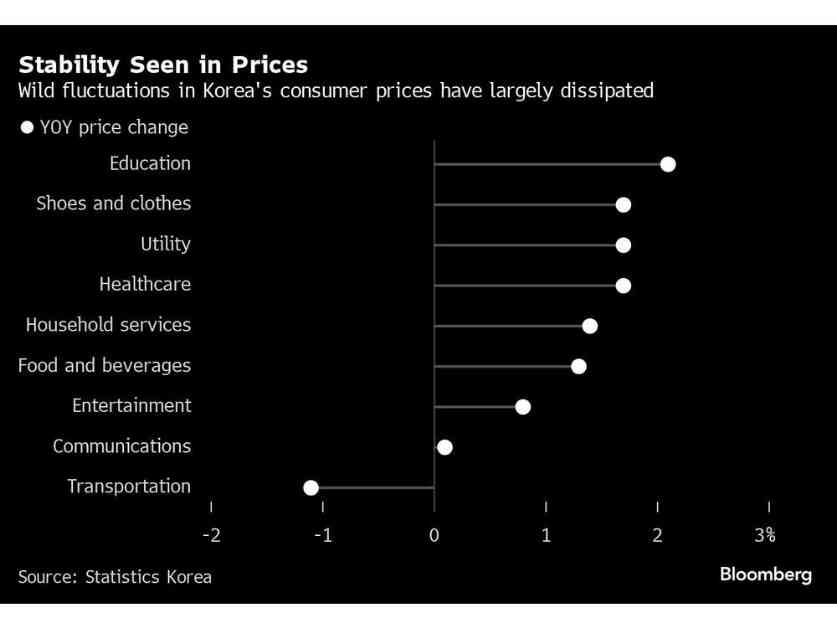

South Korea’s consumer inflation has shown signs of stability as the pace of price growth picked up less than anticipated for the third consecutive month, staying below the central bank’s target. In November, consumer prices rose by 1.5% from the previous year, slightly accelerating from October’s 1.3% increase, according to the statistics office.

Back-to-Back Interest Rate Cuts

The Bank of Korea responded to the economic landscape by implementing successive interest rate cuts in the last two months to bolster economic momentum. Concerns over sluggish economic growth arose after third-quarter gross domestic product figures fell short of expectations. Additionally, the potential return of Donald Trump to the White House could introduce trade-related challenges such as tariffs, impacting South Korea’s economy.

Notably, KB Securities economist Gweon Heejin highlighted the potential impact of trade tensions on South Korea’s currency and future inflation rates. He anticipates the Bank of Korea to execute two rate cuts in the first half of 2025. The central bank’s forecast suggests a slowdown in economic growth from 2.2% this year to 1.9% next year, reflecting a moderation in export momentum.

Expert Insights and Economic Outlook

Bloomberg Economics underscored the subdued inflation as a catalyst for further rate cuts by the Bank of Korea in 2025. With weakening private spending, a cooling export rally, and lingering credit risks in construction, the BOK may accelerate its easing campaign in response. The global policy decisions of central banks like the Federal Reserve are expected to influence the BOK’s future actions.

Consumer prices excluding energy and food items rose by 1.9% in November compared to the previous year, indicating controlled underlying inflationary pressures. The cost-of-living index surged by 1.6% year-on-year, while the price index for fresh foods saw a slight uptick. Utility costs associated with electricity, gas, and water remained stable, maintaining a consistent growth rate.

In conclusion, South Korea’s inflation has shown resilience and stability amidst global economic shifts and domestic challenges. The future trajectory will depend on various factors, including trade dynamics, global central bank policies, and domestic economic performance.

Conclusion

As consumers and businesses navigate through evolving economic landscapes, monitoring inflationary trends becomes crucial for informed decision-making. The nuanced interplay of global and local factors underscores the need for adaptive policy responses and strategic planning. By staying attuned to market dynamics and expert analyses, stakeholders can better position themselves to thrive in dynamic environments, fostering resilience and growth.