Southwest Airlines is gearing up for some tough decisions in order to increase profits and stay competitive in the ever-evolving airline industry. With pressure from activist investor Elliott Investment Management, the company has announced a series of changes to its business model aimed at boosting revenue.

Sweeping Changes Ahead

One of the major shifts Southwest is making is moving away from its traditional open seating policy to assigned seats. This change not only provides customers with more certainty about where they will be sitting but also allows the airline to offer seats with more legroom at a higher fare. Additionally, Southwest will be introducing red-eye flights to cater to passengers looking for more options when it comes to travel times.

In a video message to staff, COO Andrew Watterson emphasized the importance of these changes in driving the company back to profitability. He acknowledged that difficult decisions lie ahead but assured employees that the goal is to ensure the long-term success of the airline. While Watterson did not specify the nature of these decisions, he hinted at potential changes to the airline’s network in order to streamline operations and focus on profitable routes.

Adapting to the Market

Southwest is also making strides in expanding its reach by allowing its flights to be listed on popular travel platforms such as Google Flights and Kayak. This move is aimed at reaching a broader audience and attracting younger consumers who are more likely to use online tools to book their travel. By diversifying its marketing strategies, Southwest hopes to stay relevant in an increasingly digital world.

The airline is set to release an updated schedule for flights through June 4, signaling its commitment to transparency and keeping both employees and customers informed about any changes. While there are no plans for furloughs at this time, Southwest may reduce its presence in certain cities to focus on more profitable routes. Employees affected by these changes may have the opportunity to transfer to other locations within the company.

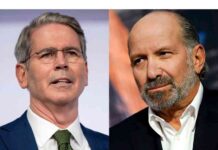

Investor Pressure and Leadership Changes

Elliott Investment Management has been vocal in its criticism of Southwest’s management and has called for a leadership change at the airline. The activist investor believes that the company needs to take more decisive action to improve its financial performance. In response to this pressure, executive chairman and former CEO Gary Kelly announced that he would step down after the next shareholder meeting, paving the way for potential leadership changes within the company.

As Southwest prepares to unveil more details about its initiatives and route changes at an upcoming investor day, the airline remains focused on its goal of increasing profitability and maintaining a strong position in the market. By making strategic decisions and adapting to the evolving needs of customers, Southwest is positioning itself for long-term success in the competitive airline industry.