The current political landscape, specifically the tightening presidential race, has ignited a flurry of tax planning activities among ultra-wealthy investors. With the possibility of a higher estate tax looming, advisors and tax attorneys are seeing a surge in interest from affluent individuals looking to secure their assets for future generations.

The estate tax exemption, which allows individuals to transfer up to $13.61 million (and couples up to $27.22 million) to family members without incurring estate or gift taxes, is set to expire at the end of 2025 along with other provisions of the 2017 Tax Cuts and Jobs Act. If the exemption does expire, the threshold for tax-free gifts will drop significantly, potentially causing a significant financial impact on wealthy families.

The uncertainty surrounding the future of the estate tax exemption has prompted many wealthy Americans to reevaluate their financial strategies. In particular, the possibility of Vice President Kamala Harris, who has advocated for higher taxes on those making over $400,000, assuming office has led to increased concerns among affluent individuals.

The looming expiration of the estate tax exemption has far-reaching implications for inheritances and the transfer of wealth from older to younger generations. With an estimated $84 trillion expected to be passed down in the coming decades, the potential changes to estate tax laws are prompting many families to accelerate their gifting plans.

Wealth advisors and tax attorneys are advising their clients to carefully consider the implications of the estate tax changes and make informed decisions based on their individual circumstances. While maximizing gifts now may seem appealing from a tax perspective, it’s essential for families to also consider the personal and familial dynamics involved in wealth transfers.

The Impact of Political Uncertainty on Wealth Planning

The uncertainty surrounding the outcome of the presidential race and the potential changes to tax laws have created a sense of urgency among wealthy families. The possibility of a divided government or a Democratic president has spurred many affluent individuals to take proactive measures to protect their assets.

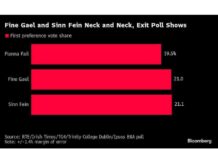

With Vice President Kamala Harris and former President Donald Trump neck-and-neck in the polls, the fate of the estate tax exemption hangs in the balance. The potential for higher taxes on the wealthy has prompted many to expedite their gifting plans to take advantage of the current tax benefits before they potentially expire.

As the political landscape continues to evolve, wealthy families are faced with the challenge of balancing their financial goals with the uncertainty of future tax laws. Estate planning strategies that were once considered long-term goals are now being fast-tracked to ensure that families can maximize their wealth transfer opportunities.

Wealth Transfer Strategies in the Face of Uncertainty

The impending changes to the estate tax exemption have prompted many wealthy families to reassess their wealth transfer strategies. While gifting large sums of money now may seem like a prudent move to capitalize on the current tax benefits, it’s crucial for families to consider the long-term implications of their decisions.

Wealth advisors are emphasizing the importance of taking a holistic approach to wealth planning, considering not only the tax implications but also the personal and family dynamics involved. While maximizing gifts may offer short-term tax advantages, families must also consider the impact on their financial security and the well-being of their heirs.

Challenges and Considerations in Wealth Planning

The uncertainty surrounding the estate tax exemption expiration has created challenges for wealthy families seeking to navigate the complex landscape of wealth planning. The potential for higher taxes and changes to estate tax laws have left many affluent individuals grappling with the best course of action to protect their assets.

One of the key considerations for families is determining the optimal timing and amount of gifts to make in light of the impending changes to the estate tax exemption. While gifting now may offer immediate tax benefits, families must also weigh the potential risks of giving away assets unnecessarily if the tax laws remain unchanged.

Wealth advisors are urging their clients to approach wealth planning with a long-term perspective, considering not only the current tax benefits but also their overall financial goals and objectives. By taking a comprehensive approach to wealth transfer strategies, families can ensure that their assets are protected and their heirs are well-positioned for the future.

In conclusion, the surge in wealth transfers to children in response to the potential changes to the estate tax exemption highlights the impact of political uncertainty on wealth planning. As affluent individuals grapple with the looming expiration of the current tax benefits, it’s essential for families to carefully consider their options and make informed decisions that align with their long-term financial goals. By working closely with wealth advisors and tax attorneys, families can navigate the complexities of wealth planning and ensure that their assets are protected for future generations.