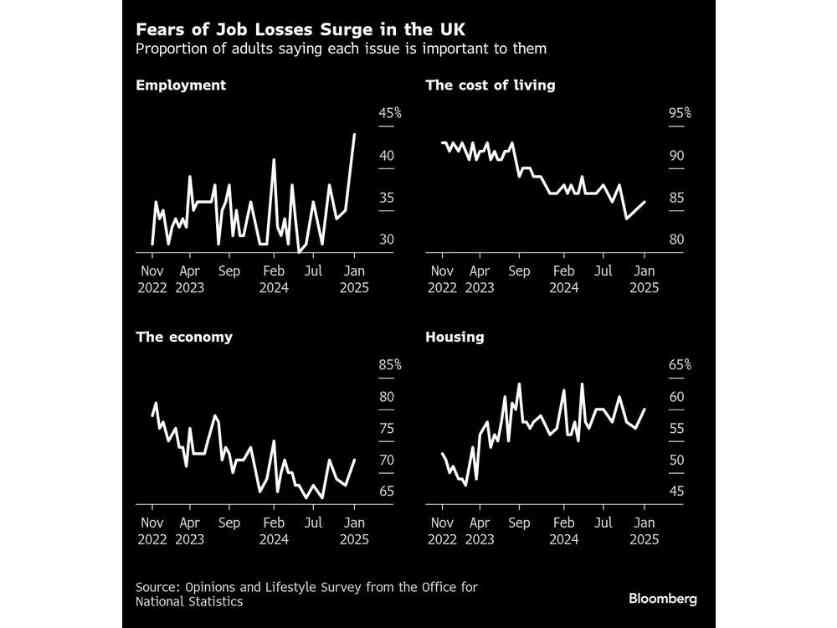

The British consumer landscape has been a challenging terrain for Prime Minister Keir Starmer and his Labour government since their rise to power. A recent budget has left households cautious and frugal, leading to a decline in spending on non-essential items like dining out. Inflation is on the rise, and fears of job loss loom large, as the economy struggles to rebound from the impact of the pandemic.

Consumer Caution and Economic Impact

Recent data shows that British consumers are cutting back on expenses and increasing savings, reflecting a sense of pessimism and uncertainty about the future. The aftermath of the pandemic has wiped out the excess savings that many had accumulated, leaving them vulnerable to the current surge in prices. This cautious approach to spending has significant implications for the overall economy, as consumer spending accounts for a significant portion of the GDP.

Chancellor of the Exchequer Rachel Reeves has outlined plans to stimulate economic growth through investments in housing and infrastructure. However, the immediate concern for many workers is the impact of upcoming changes like a payroll-tax increase and a rise in the minimum wage. The looming question of job security and wage growth adds to the overall sense of financial unease among households.

Expert Insights and Economic Outlook

Economic experts like Jessica Hinds from Fitch Ratings point out that the decline in consumer spending is driven by a combination of cost-of-living factors and wavering confidence. The cooling labor market and the overall impact of recent financial shocks have only added to the uncertainty faced by households. While wages are increasing slightly faster than prices, the overall rise in living standards is minimal, with many struggling to keep up with inflation.

Raoul Ruparel, director for Boston Consulting Group’s Centre for Growth, highlights that the idea of consumers unleashing pent-up savings once confidence returns may be a misconception. The lowest-paid workers are experiencing some wage growth, but the focus remains on meeting essential expenses rather than discretionary spending. Wealthier households, on the other hand, are more inclined to save their funds rather than spend them, viewing savings as a form of security.

The recent tax increases announced by the Labour government have further dampened consumer confidence, leading to a decrease in spending on non-essential items. The economy’s growth has been sluggish, and households are facing additional pressures from rising energy and food costs. The reluctance to spend on major purchases indicates a broader trend of financial caution among British consumers.

As the Bank of England considers potential interest rate cuts to stimulate spending, concerns about the long-term impact of consumer reticence linger. Catherine Mann’s unexpected dissent from the majority opinion on the Monetary Policy Committee underscores the gravity of the situation. Her warning about sustained subdued demand due to high savings rates and unemployment concerns paints a sobering picture of the challenges ahead.

In conclusion, the challenges faced by British consumers are multifaceted and have significant implications for the overall economy. As households navigate uncertain financial waters, the government and economic experts are working to find solutions that balance growth with stability. The road ahead may be rocky, but with strategic interventions and a deeper understanding of consumer behavior, there is hope for a more resilient economic future.