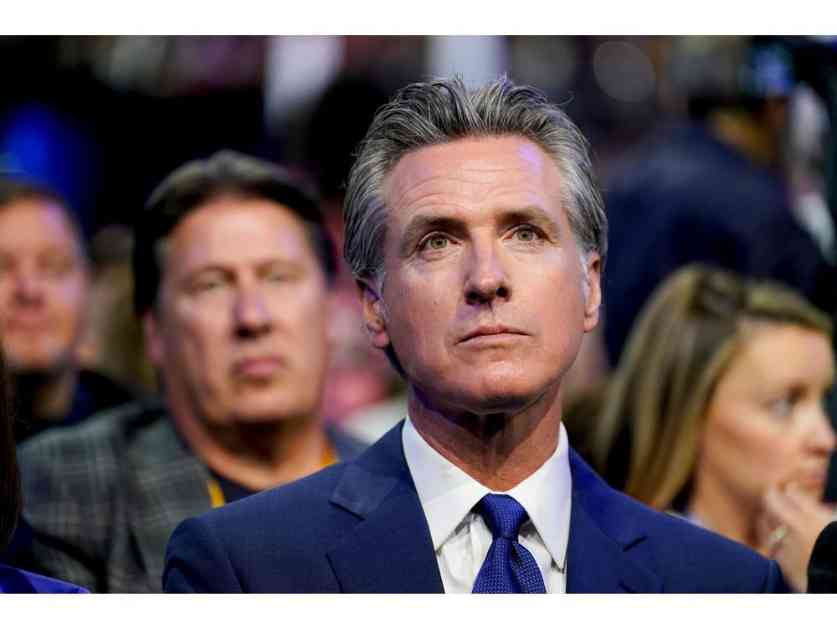

California Governor Gavin Newsom announced a significant increase in annual tax credits for film and television production in the state, aiming to boost it to around $750 million. This move comes as a response to the recent decline in content production in California, which Newsom described as a crisis. The increase from the current $330 million is pending approval of California’s proposed 2025-2026 budget and would mark the first major overhaul of the incentive program since 2014.

The decision to double the film tax credits is a strategic one, as California has been facing tough competition from other regions like Georgia, Canada, and the UK, which offer more generous rebates to attract productions. Hollywood, known for its iconic film studios, has been losing out on big-budget projects to these locations, impacting the local economy and leaving many industry workers without jobs.

Last year’s actors and writers strikes, along with a decrease in content spending by major entertainment companies, have further exacerbated the situation in California. The state has been struggling to keep up with the evolving landscape of the film industry, especially with the rise of streaming services that are reshaping the way content is produced and consumed.

In response to the challenges faced by California’s film industry, Newsom’s decision to double the tax credits is seen as a positive step towards revitalizing Hollywood and bringing back jobs to the state. Industry stakeholders, including local legislators and unions, have expressed support for the move, emphasizing the need for California to remain competitive in the global market.

While the increase in tax credits is a welcome development, some industry experts have pointed out that California still lags behind other states in terms of funding and eligibility criteria for incentive programs. There is a call for continued innovation and adaptation to ensure that California remains a top destination for film and television productions.

Overall, Newsom’s initiative to double film tax credits reflects a commitment to supporting the film industry in California and addressing the challenges it faces in a rapidly changing environment. By investing in the sector and providing incentives for productions, the state aims to position itself as a leading hub for entertainment and create opportunities for industry professionals to thrive.