**Challenges Faced by Companies Leading to Closure in Nigeria: A Comprehensive Analysis**

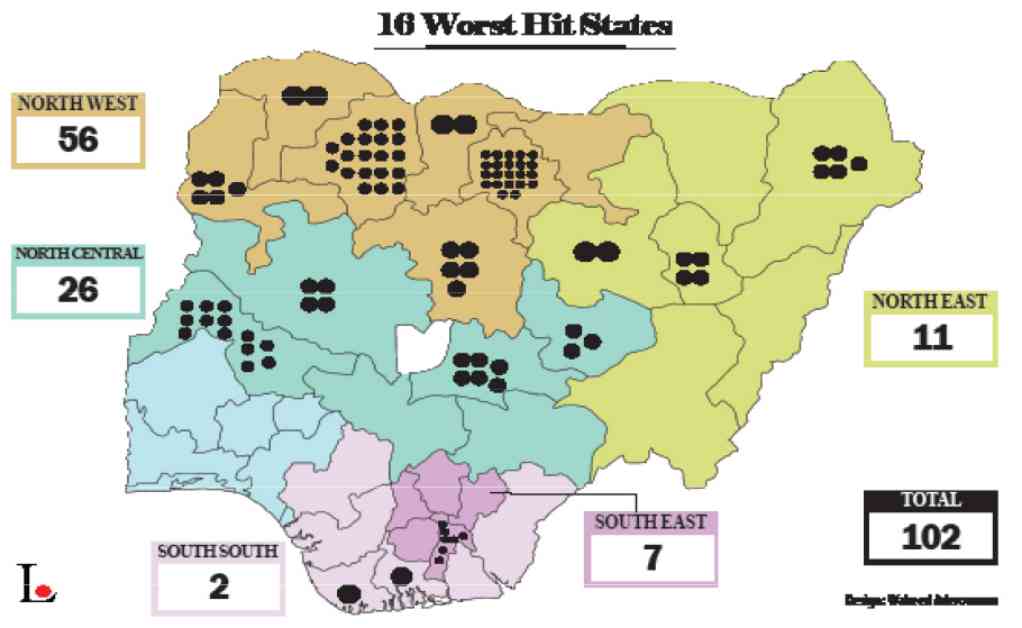

The manufacturing sector in Nigeria has been facing significant challenges over the past 24 years, resulting in the closure of 102 companies across 16 states. The closure of these companies has had a detrimental impact on the nation’s economy, leading to increased unemployment and social unrest. This trend underscores the various obstacles that manufacturers in Nigeria have been grappling with, including inconsistent government policies, inadequate infrastructure, and security concerns.

**Multifaceted Challenges Faced by Industries**

The challenges faced by the manufacturing sector in Nigeria are multifaceted and require urgent government intervention and strategic planning to create a conducive business environment and revive the sector. In an attempt to address these issues, Nigeria has invested billions in interventions such as the National Industrial Revolution Plan (NIRP), the Economic Recovery and Growth Plan (ERGP), and the Industrial Development Fund. These initiatives aim to provide financing for industrial projects and stimulate growth in the manufacturing sector.

**State-Specific Impact of Company Closures**

The closure of companies in Nigeria has had a significant impact on various states across the country. In Kaduna State, major closures include Kaduna Textile Limited, Arewa Textile, and United Nigeria Textile, leading to a loss of employment opportunities in the region. Similarly, Zamfara State has witnessed the closure of 20 companies, including Zamfara Textile Industries Limited and Gusau Oil Mills, resulting in economic hardship and job losses.

In Kwara State, reputable companies like Global Soap and Detergent Industry and Nigeria Paper Mills have shut down, reflecting a broader trend of economic challenges and inadequate support for local industries. Borno State has been particularly hard-hit, with the ongoing Boko Haram insurgency contributing to the closure of companies like Deribe Oil Company. The lack of security in the region has hampered investment and business operations, making it challenging to revive these enterprises.

**Government Intervention to Prevent Industry Collapse**

In response to the challenges faced by the manufacturing sector, the federal government has implemented strategic measures to prevent the collapse of industries in Nigeria. The Bank of Industry (BoI) has disbursed loans at single-digit interest rates to the manufacturing sector and small businesses, aiming to stimulate economic growth and foster industrial development. In 2023, the BoI disbursed N496.72 billion in loans to 75,809 beneficiaries, marking a significant increase in financial support for businesses.

President Bola Tinubu’s economic recovery goals have emphasized the government’s commitment to empowering Nigerian enterprises and promoting sustainable operations. The newly-launched N200 billion Presidential Intervention Fund (PIF) is designed to provide crucial financial support to micro, small, and medium enterprises (MSMEs) and manufacturers nationwide. The fund will allocate N75 billion each to MSMEs and the manufacturing sector, with repayable loans intended to stimulate economic growth and support industrial development.

**Continued Support for MSMEs and Manufacturers**

The government’s efforts to support MSMEs and manufacturers in Nigeria are ongoing, with the continuation of initiatives like the Presidential Intervention Fund (PIF) providing vital financial support to businesses. Minister of Industry, Trade, and Investment, Dr Doris Uzoka-Anite, highlighted the importance of this support in strengthening the country’s business environment and fostering economic growth.

For MSMEs, eligible applicants can access loans of up to N1 million, provided they have been operational for at least one year or are registered start-ups. Manufacturers, on the other hand, can secure loans of up to N1 billion for working capital or asset financing, with specific documentation and repayment terms. These loans are aimed at stimulating economic growth, supporting business operations, and promoting industrial development in Nigeria.

In conclusion, the challenges faced by companies leading to closure in Nigeria are complex and require comprehensive solutions from both the government and industry stakeholders. By addressing issues such as inconsistent policies, inadequate infrastructure, and security concerns, Nigeria can create a conducive business environment that fosters growth and sustainability in the manufacturing sector. Through strategic interventions and continued support for businesses, the nation can overcome these challenges and pave the way for a thriving industrial landscape.