Understanding the Dislike for Inflation Among the Public vs. the Political Understanding

In recent times, there has been a growing concern among the public regarding the issue of inflation. Prices have risen by approximately 15 per cent since the Albanese government came into power, causing frustration and discontent among the general population. This sentiment is evident in various discussions and debates, prompting questions about the underlying reasons for such widespread dissatisfaction.

Policy Perspectives on Inflation

From a policy perspective, inflation is a complex economic phenomenon that can have far-reaching implications for the overall health of an economy. Inflation refers to the general increase in prices of goods and services over a period of time, leading to a decrease in the purchasing power of a currency. While a moderate level of inflation is considered normal and even beneficial for economic growth, high levels of inflation can have detrimental effects on consumers, businesses, and the overall stability of the economy.

In the case of the Albanese government, the rise in inflation has been a point of contention, with many questioning the effectiveness of the government’s policies in addressing this issue. The public’s dislike for inflation can be attributed to several factors, including the impact on their daily expenses, savings, and overall standard of living. As prices continue to rise, consumers are forced to allocate more of their income towards basic necessities, leaving less room for discretionary spending and savings.

Economic Implications of Inflation

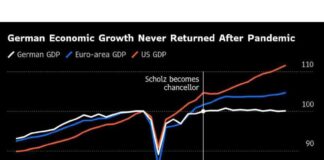

From an economic perspective, inflation can have both positive and negative implications, depending on the context and severity of the situation. Inflation is often viewed as a sign of a growing economy, as it indicates increased demand for goods and services. However, high levels of inflation can erode the value of money, leading to a decrease in purchasing power and a rise in the cost of living.

In the case of the Albanese government, the rise in inflation can be seen as a reflection of the overall economic conditions in the country. Despite the government’s efforts to stimulate economic growth and create jobs, the increase in prices has dampened the public’s perception of the government’s performance. This disconnect between the political understanding of the economy and the public’s lived experience highlights the need for effective communication and policy interventions to address the concerns of the public.

Economics Explained: Factors Contributing to Inflation

Inflation is a multifaceted economic phenomenon that is influenced by a variety of factors, including monetary policy, fiscal policy, supply and demand dynamics, and external shocks. Understanding the underlying causes of inflation is crucial for policymakers and economists to develop effective strategies to manage and mitigate its impact on the economy.

Monetary Policy: One of the key drivers of inflation is monetary policy, particularly the actions taken by central banks to control the money supply and interest rates. By adjusting interest rates and engaging in open market operations, central banks can influence the level of inflation in the economy. In the case of the Albanese government, the impact of monetary policy on inflation remains a subject of debate, with some arguing that the government’s approach has been ineffective in addressing rising prices.

Fiscal Policy: In addition to monetary policy, fiscal policy plays a crucial role in influencing inflation through government spending, taxation, and budget deficits. By implementing appropriate fiscal measures, governments can stimulate or restrain economic activity, which in turn affects the level of inflation. The effectiveness of fiscal policy in managing inflation depends on a range of factors, including the government’s fiscal discipline, political priorities, and external economic conditions.

Supply and Demand Dynamics: Another important factor contributing to inflation is the interplay between supply and demand in the economy. When demand for goods and services exceeds supply, prices tend to rise, leading to inflationary pressures. Factors such as population growth, changes in consumer preferences, and disruptions in the supply chain can influence supply and demand dynamics, thereby affecting the overall price level in the economy.

External Shocks: External shocks, such as changes in global commodity prices, exchange rates, and geopolitical events, can also have a significant impact on inflation. These external factors can disrupt the stability of the economy and lead to fluctuations in prices, causing uncertainty and volatility in the market. In the context of the Albanese government, external shocks have played a role in driving inflation, highlighting the interconnected nature of the global economy.

Conclusion

In conclusion, the public’s dislike for inflation can be attributed to a combination of economic, social, and political factors that influence their perceptions and experiences. While policymakers and economists may have a nuanced understanding of inflation and its implications, it is essential to bridge the gap between the political understanding of the economy and the public’s lived reality. By addressing the underlying causes of inflation and implementing targeted policies to mitigate its impact, governments can build trust and confidence among the public, fostering a more sustainable and inclusive economic environment.