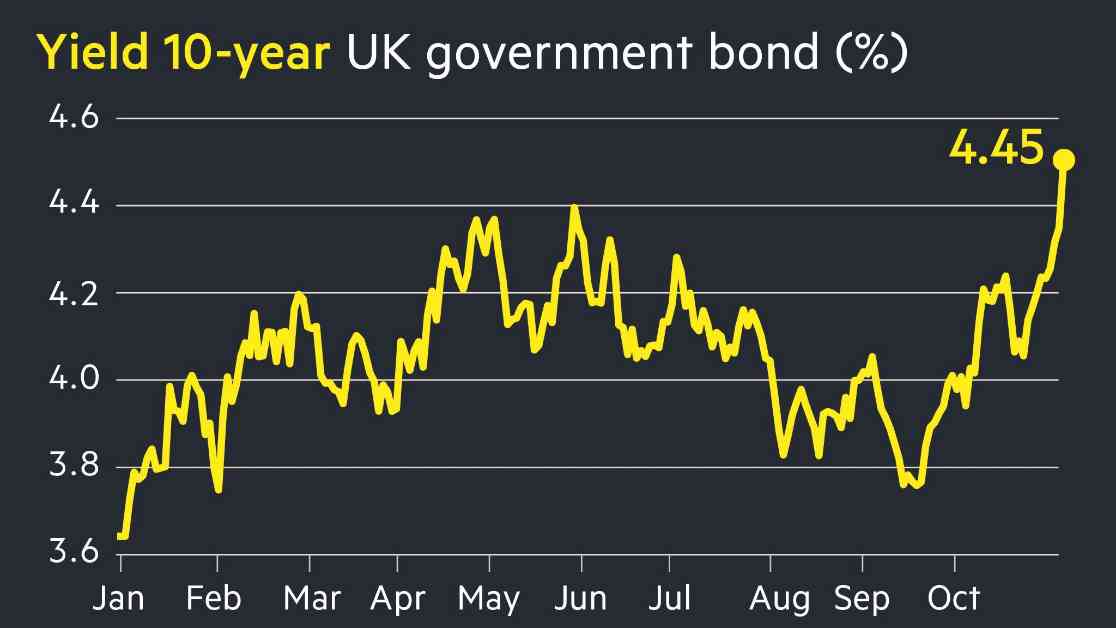

UK Borrowing Costs Surge as Gilt Sell-Off Intensifies

The UK is currently experiencing a surge in borrowing costs as the sell-off of government bonds, known as gilts, intensifies. This increase in borrowing costs could have significant implications for the country’s economy and financial markets.

The rise in borrowing costs is due to a combination of factors, including concerns about rising inflation, expectations of interest rate hikes by the Bank of England, and uncertainty surrounding the UK’s economic recovery post-pandemic. As a result, investors are demanding higher yields on gilts, driving up borrowing costs for the government.

This surge in borrowing costs could make it more expensive for the UK government to finance its budget deficit and fund public spending. Higher borrowing costs could also put pressure on businesses and consumers, leading to reduced investment and consumption, which could in turn slow economic growth.

In response to the surge in borrowing costs, the Bank of England may need to take action to stabilize the bond market and prevent a further sell-off of gilts. This could involve implementing measures such as increasing its asset purchase program or providing forward guidance on interest rates.

Overall, the increase in borrowing costs in the UK is a sign of the challenges facing the economy as it seeks to recover from the impact of the pandemic. It underscores the importance of carefully managing the country’s public finances and monetary policy to ensure a stable and sustainable economic recovery.