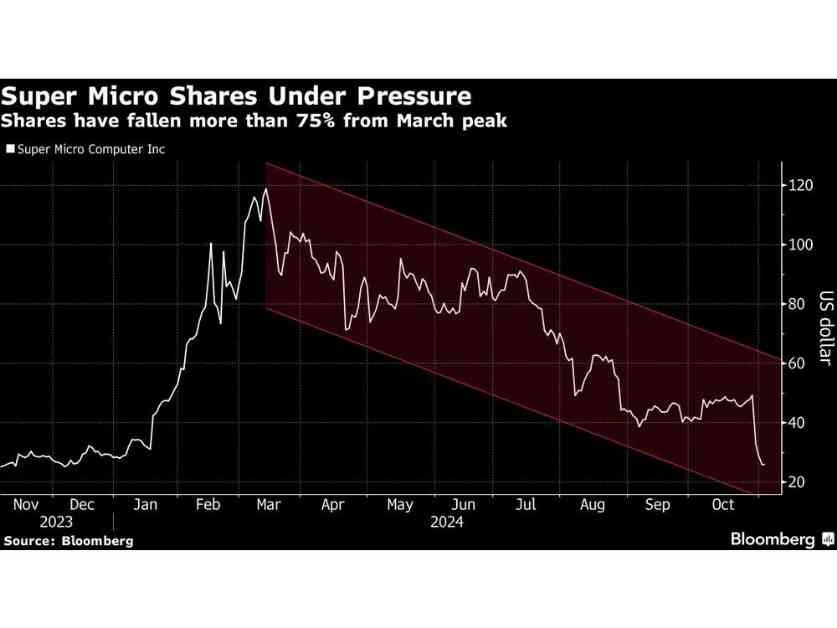

Super Micro Computer Inc. has been facing a tough time lately due to issues with its auditors, which has raised concerns among investors. The company’s shares have taken a significant hit, dropping more than 75% since March. The resignation of its auditor, Ernst & Young LLP, has further complicated matters, leading to questions about the company’s future listing on Nasdaq and its inclusion in the S&P 500 index.

Super Micro is expected to provide a business update soon, and investors are eagerly waiting to hear about its plans to address Nasdaq’s compliance requirements. The company missed the deadline to file its annual 10-K report in August, putting its listing status in jeopardy. While Nasdaq rules allow for a plan to be submitted to regain compliance by mid-November, Ernst & Young’s resignation has made the situation more challenging.

Analysts are skeptical about Super Micro’s ability to meet the deadlines without an auditor in place. The risk of delisting looms large, and if that happens, it could also lead to the company’s removal from the S&P 500 index. This would result in forced selling of shares by institutional investors, further impacting the company’s financial stability.

Super Micro has had a tumultuous history with delisting, having faced a similar situation in 2019. The company managed to rejoin the exchange in 2020 after resolving an investigation by the US Securities and Exchange Commission. However, the current situation has raised concerns about potential restatements of financial reports and the company’s overall financial health.

Analysts warn that financial issues could impact Super Micro’s growth and customer relationships. The uncertainty surrounding the company’s listing status and financial integrity could deter customers from doing business with them, opening up opportunities for competitors like Dell Technologies Inc. to gain market share.

Overall, the future looks uncertain for Super Micro as it navigates through these challenging times. The company’s ability to address the auditor issues and regain compliance with Nasdaq will be crucial in determining its future prospects in the market. Investors and stakeholders will be closely monitoring the situation as it unfolds to make informed decisions about their investments.