Earnings season is underway, and the US stock market is facing a significant test after a $9 trillion rally in 2024. Analysts are predicting that companies in the S&P 500 Index will report their weakest results in four quarters, with only a 4.3% increase in third-quarter profits compared to last year. Although initial projections were higher, the stock market continues to hit record highs, suggesting potential room for an upside earnings surprise.

Key companies like JPMorgan Chase & Co., Wells Fargo & Co., and BlackRock Inc. have already kicked off the earnings season. More major companies like Citigroup Inc., Netflix Inc., and JB Hunt Transport Services Inc. are set to release their results in the coming weeks. Here are five essential themes to watch during this earnings season:

1. AI Slows Down: The growth in S&P 500 earnings is primarily driven by large technology companies benefiting from artificial intelligence. While the Magnificent Seven firms are expected to post an 18% rise in profits, the rate of increase is slowing down compared to previous years.

2. Stock Picker’s Paradise: Individual stocks may experience significant swings after earnings reports, offering investors opportunities for gains. While some sectors like technology, communication services, and health care are expected to see profit expansions, the energy sector may report a decline.

3. All About Margins: Profit margins are a crucial measure of a company’s profitability. Net-income margins are expected to decline slightly, reflecting challenges in passing on input costs to customers. Energy and real estate stocks are projected to have the weakest profit margins.

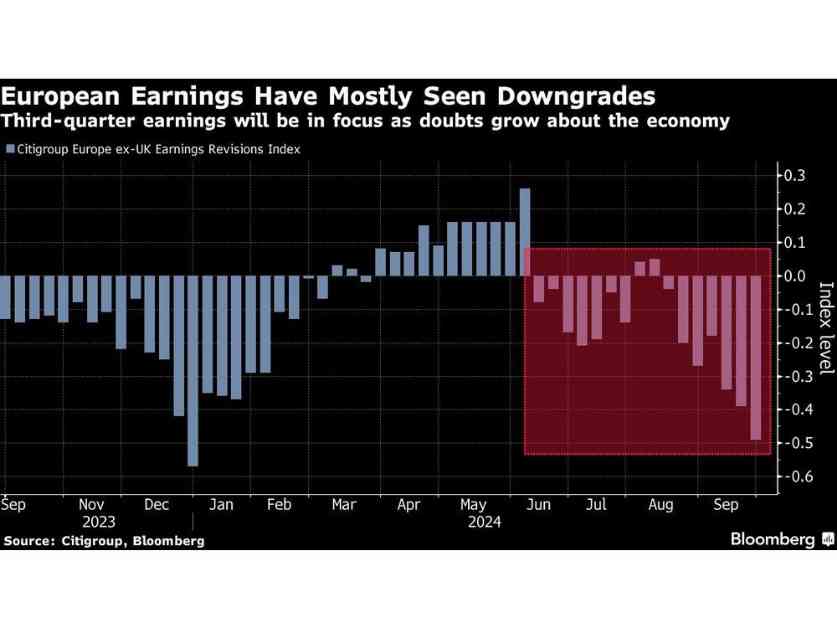

4. Choppy European Markets: In Europe, the earnings season could be a turning point for the Stoxx 600 Index. Analysts have reduced profit estimates, and any guidance on weakening consumer demand could impact stock prices.

5. Election Focus: With the US presidential election approaching, investors will be listening for insights on economic, trade policy risks, and other political issues from corporate executives. History suggests that corporate investment activity accelerates after US presidential elections, potentially driving capital investment in the future.

As earnings reports continue to roll in, these themes will be crucial for traders and investors to monitor. Despite lowered expectations, the stock market’s resilience and potential for upside surprises indicate an exciting earnings season ahead.