**Top 5 Charts to Monitor in Global Commodity Markets This Week**

As the global commodity markets continue to fluctuate, it is essential for investors and stakeholders to keep a close eye on key charts that can provide insights into the trends and movements in various sectors. From steel to sugar, oil to dairy, and climate tech, here are the top five charts to monitor in the global commodity markets this week.

**Steel Industry Trends in North America**

The North American steel industry is currently facing challenges such as uninspired US demand, slumping prices, and an overabundance of Chinese steel. Industry experts are gathering in Atlanta for the annual SMU Steel Summit to discuss these pressing issues and strategize for the future. With Chinese steel exports impacting prices worldwide, it will be crucial to see how the market reacts and whether US demand will show signs of recovery.

**Insights from Brazilian Sugar Production**

Brazil, the world’s top sugar exporter, plays a significant role in shaping global sugar prices. As the country progresses through its sugar-cane harvest, upcoming data on sugar production will provide valuable insights into the market’s supply and demand dynamics. Traders will be closely watching a report from industry group Unica to assess whether the market remains well supplied or faces potential disruptions due to weather conditions.

**Crude Oil Stockpiles at Cushing, Oklahoma**

The crude oil stockpiles at Cushing, Oklahoma, a key hub for oil storage in the US, have reached their lowest levels since February. This decrease in stockpiles can be attributed to various factors, including refiners ramping up activity after unexpected outages and declining crude shipments from Canada. The tight supply situation at Cushing has supported a bullish backwardation structure in US crude futures, indicating potential price increases if the trend continues.

**Trade Dispute Impact on Dairy Industry**

The recent anti-subsidy investigation by China into dairy imports from the European Union has added to the ongoing trade dispute between the two regions. This investigation, targeting various dairy products, including cheese, highlights the challenges faced by the dairy industry amidst escalating trade tensions. With China being a significant export market for EU dairy, any disruptions in trade can have far-reaching consequences on global dairy prices and supply chains.

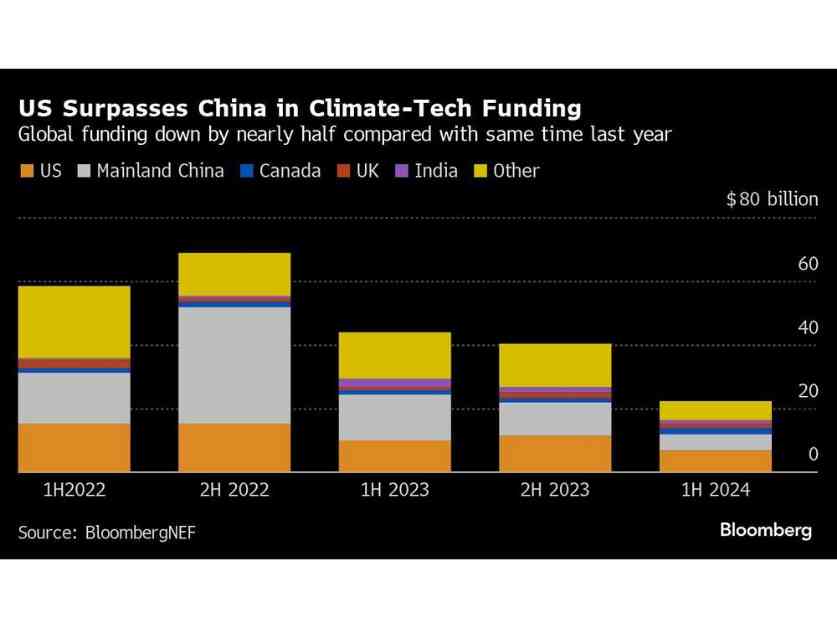

**Investments in Climate Tech**

The US has emerged as a leading investor in climate tech, surpassing China in funding for technology aimed at addressing the climate crisis. Despite the US’s significant contributions, global funding for climate tech has decreased by nearly 50% compared to the previous year. This trend underscores the importance of continued investments in sectors like electric vehicles, batteries, and clean power to combat climate change effectively.

In conclusion, monitoring these key charts in the global commodity markets can provide valuable insights into market trends, potential price movements, and emerging opportunities for investors and stakeholders. By staying informed and analyzing the data presented in these charts, market participants can make well-informed decisions and navigate the complex landscape of commodity trading successfully.