China has experienced a notable increase in imports of commodities in recent months, particularly in August, as industries gear up for the upcoming peak demand season that typically begins in the fall. This surge in imports comes as various sectors in the Chinese economy prepare for heightened activity in anticipation of the winter months, leading to a greater need for raw materials.

Despite the uptick in imports, China continues to grapple with a deflationary economic environment that has dampened overall demand and resulted in overflowing stockpiles. As a result, some imports have fallen short compared to previous years. However, the recent uptick in imports from July indicates a positive trend in demand as industries ramp up operations ahead of the winter season.

In August, crude oil imports saw a significant increase of 16% compared to July, totaling 49.1 million tons. This surge in imports was attributed to refiners securing record volumes of cheaper Iranian oil and a slight improvement in profit margins. While the monthly increase is promising, the overall figure remains lower compared to the previous year, reflecting the broader economic challenges facing China, including a slowing economy and the rapid adoption of electric vehicles.

Natural gas imports also reached their highest levels this year as China prioritizes securing a stable supply for heating and power generation. Similarly, coal shipments remained elevated, although purchases of coking coal may have been impacted by the downturn in the steel sector.

Iron ore imports, while slightly easing from July, maintained levels above 100 million tons. However, port inventory levels are at an all-time high for this time of year, leading to a decline in prices amidst a contraction in China’s steel market due to ongoing property market challenges.

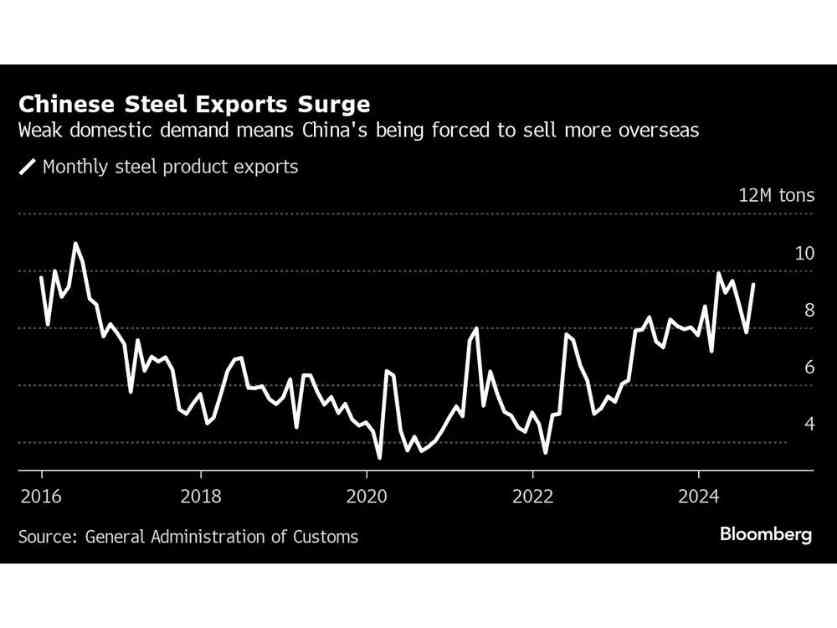

In a bid to address its surplus, China saw a notable increase in steel exports, with shipments rising by 21% from July to 9.5 million tons. Despite trade partners’ efforts to protect domestic industries, China’s steel exports continue to play a crucial role in managing surplus production.

Moreover, imports of copper concentrate surged to their second-highest levels ever to support new Chinese smelting capacities, despite global supply constraints. This surge in copper concentrate imports affected purchases of copper metal, which dropped to their lowest levels since February.

In the agricultural sector, soybean imports climbed to a record 12.1 million tons, driven by the arrival of substantial quantities of Brazilian shipments that were secured earlier in the year. This surge in soybean imports underscores China’s reliance on imported agricultural products to meet domestic demand.

On the policy front, China announced plans to implement carbon-trading compliance obligations on steel, aluminum, and cement producers next year. This move is part of China’s broader efforts to extend its carbon market and compel polluting sectors to reduce emissions, aligning with global sustainability goals.

Despite economic challenges, China’s exports unexpectedly picked up in August, offering a much-needed boost to an economy grappling with deflationary pressures. However, this uptick in exports has also raised tensions with trade partners, underscoring the complexities of China’s economic landscape.

In the energy sector, China’s Envision Energy unveiled plans to develop a $1 billion green hydrogen industrial park in Spain, aligning with the European nation’s greenhouse gas reduction goals. This initiative highlights China’s commitment to advancing sustainable energy solutions on a global scale.

In Canada, canola supplies are piling up following China’s initiation of an anti-dumping investigation, signaling potential challenges for Canadian exporters. The investigation has raised concerns about the future of canola exports to China, a key market for Canadian agricultural products.

Looking ahead, China’s economic calendar for the upcoming week includes key events such as trade data releases, government meetings, and updates on various sectors including coal, iron ore, and copper imports. These events will provide valuable insights into China’s economic performance and policy developments in the coming days.

As China navigates through a challenging economic environment, the country’s efforts to boost commodity imports and stimulate domestic demand will play a crucial role in shaping its economic trajectory in the months ahead. By closely monitoring key indicators and policy measures, China aims to maintain a balanced approach to economic growth while addressing pressing environmental and trade challenges.