Donald Trump’s victory in the US presidential election has sent shockwaves through the global economy. World leaders are now bracing for the impact of his upcoming administration on various sectors.

In China, factories have increased shipments ahead of the Christmas holidays in anticipation of potential trade tensions. Emerging markets have been hit hard as the US dollar and yields surged. Economists in the US predict that Trump’s proposed policies, particularly on tariffs, could lead to inflation and slower economic growth.

Despite the Federal Reserve’s recent interest rate cut, Chair Jerome Powell stated that Trump’s re-election will not affect the central bank’s policy decisions in the near term. The Bank of England has also reduced borrowing costs for the second time this year.

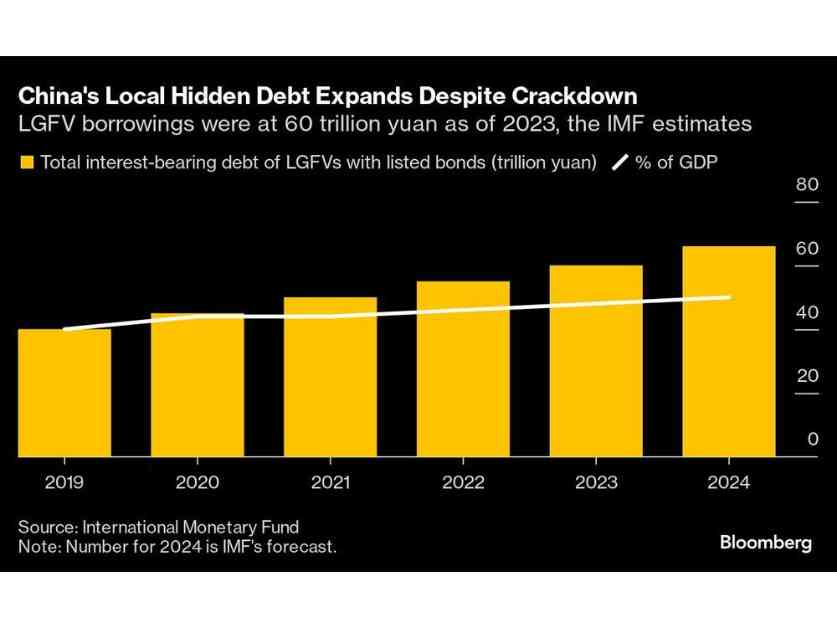

In China, officials have announced a program to refinance local debt and hinted at more aggressive fiscal policies in response to Trump’s presidency. Chinese export growth has been strong, but fears of a trade war with the US loom large.

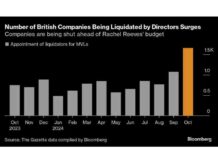

In Europe, the Bank of England faces challenges with the UK government’s increased spending plans and Trump’s tariff threats. Traders in Germany are preparing for more bond sales after a government official was removed. In Britain, deflation has affected a third of the official “shopping basket,” giving the BOE more reason to consider interest rate cuts.

In emerging markets like Brazil and Chile, inflation has exceeded expectations, leading to speculation about potential policy changes. High-yield funds in countries like Argentina and Ukraine are seeing gains, indicating further opportunities for growth.

Vietnam, a trade-dependent nation, is closely watching developments with the US as exports make up a significant portion of its economy. Other countries like Sweden, Pakistan, Czech Republic, and Gulf nations have also made policy changes in response to global economic shifts.

Overall, the global economy is bracing for the impact of Trump’s victory and preparing for potential changes in trade policies, inflation rates, and growth prospects. As world leaders navigate these uncertainties, the financial markets are experiencing significant fluctuations and investors are closely monitoring developments for future implications.