Veteran high-yield analyst Marty Fridson predicts a rise in distress for junk bond investors as banks tighten lending standards in response to the robust US economy. The Federal Reserve’s recent survey of senior loan officers revealed a significant increase in credit standards for medium-sized and larger companies, marking the most rigorous scrutiny in three years. This shift is expected to intensify pressure on borrowers already struggling with escalating trade wars and higher funding costs.

Fridson, a respected former strategist at Merrill Lynch, warns that the tightening credit standards could push more companies into the danger zone of default. Risky borrowers are facing the challenge of refinancing at elevated interest rates as the era of cheap Covid-era debt facilities comes to an end. Despite the Federal Reserve’s rate cuts starting in September, benchmarks like the 10-year Treasury yield have climbed, exposing junk-rated firms to potential downturns that could impact their earnings and lead to layoffs, ultimately affecting the broader economy.

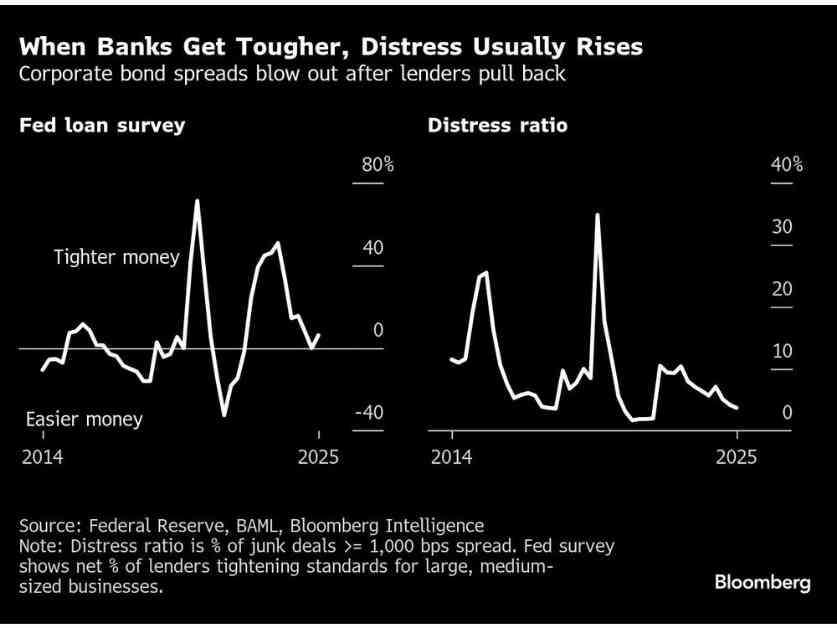

Fridson’s analysis dating back to 1997 highlights a strong correlation between lending standards and distress levels in credit markets. The distress ratio, which measures the proportion of bonds trading at spreads of 1,000 basis points or higher, dropped to 3.7% in January, well below the historical average of 12.7%. However, Fridson predicts a gradual increase in distress levels, cautioning that the ratio is likely to rise in the future.

The recent surge in lending standards poses a significant challenge for companies with immediate debt maturities, putting additional strain on the weakest players. As some struggle with prohibitively high refinancing costs, external factors like trade policies and input cost fluctuations could further destabilize debt markets. While corporate bond spreads remain tight, indicating strong demand for high-yielding debt, the risk of a sudden surge in distress remains a looming threat.

Amidst these concerns, Phil Brendel, a senior credit analyst at Bloomberg Intelligence, warns that the prolonged period of low distress ratios presents a potential powder keg situation. He emphasizes the volatile geopolitical landscape and anticipates unforeseen events that could trigger widespread market disruptions. The delicate balance between supply and demand for high-yield debt underscores the precarious nature of the current market environment.

In a rapidly evolving financial landscape, staying attuned to the subtle shifts in lending standards and distress indicators is crucial for investors and market participants. The intricate interplay between economic trends, policy changes, and global developments underscores the need for a proactive approach to risk management and strategic decision-making in the high-yield debt market.

As experts like Fridson and Brendel sound the alarm on rising distress levels and tightening lending conditions, investors and borrowers alike must navigate the evolving landscape with caution and foresight. The delicate equilibrium between risk and reward in the high-yield debt market underscores the need for vigilance and adaptability in an increasingly complex and dynamic financial environment.