Europe’s chemicals and steel industry is feeling the heat due to China’s tariffs, leaving them squeezed and struggling to stay afloat. As the latest earnings season unfolds, it’s become clear that the continent’s materials sector is facing significant challenges that are unlikely to dissipate anytime soon.

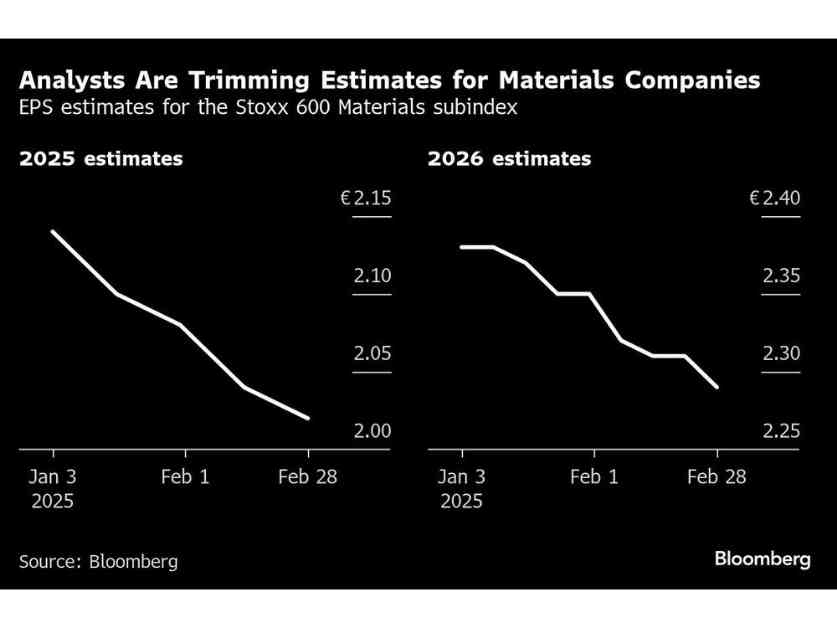

During this earnings season, a group of essential companies supplying products like plastic, aluminum, and paper have emerged as the biggest underperformers. These companies, which may not be household names, have reported a staggering number of earnings misses. Data compiled by Bloomberg reveals that over 65% of the MSCI Europe materials index failed to meet earnings per share estimates for the fourth quarter, compared to just 35% across the broader index.

The Impact of Weak Demand and Tariff Threats

The materials industry in Europe, which includes companies like Akzo Nobel NV, Yara International ASA, and Symrise AG, is grappling with weak demand in China. The economic slowdown in China has led to a decrease in construction activity, exacerbating the challenges faced by these companies. Additionally, the looming threat of US tariffs adds another layer of uncertainty to the mix.

The Road Ahead: Cost Cutting and Productivity Gains

As companies in the materials sector navigate these turbulent waters, the onus falls on cost cutting and productivity gains to drive earnings growth. However, this task is made more complicated by rising raw material prices and escalating labor costs. According to Bloomberg Intelligence strategists Kaidi Meng and Laurent Douillet, the sector’s performance hinges on these factors.

Navigating Trade Wars and Economic Uncertainty

Some industries within the materials sector are projected to fare worse than others. Basic resources like metals and forestry products, as well as chemicals, are among the sectors facing the sharpest downgrades to earnings estimates. These industries are particularly vulnerable to the impacts of a potential trade war, as noted by analysts at Goldman Sachs Group Inc.

Levies imposed on EU steelmakers could result in significant capacity cuts, while retaliatory measures may dampen global trade and reduce demand, leading to lower commodity prices. The demand for key materials like copper, essential for renewable energy and electric vehicles, may also suffer due to shifts in US policy away from renewables.

Challenges and Opportunities in the Chemicals Sector

The initial outlook for chemicals companies has been underwhelming, marked by weak demand and a complex mix of challenges. A combination of factors, including the aftermath of the pandemic, high interest rates, supply chain disruptions, and soaring energy costs, are creating headwinds for the sector. Basic chemicals used in industrial settings are particularly exposed to the automotive sector’s struggles, while specialized chemicals face challenges in sectors like food and household products.

However, there are silver linings amidst the storm. Construction materials companies like Heidelberg Materials AG and Sika AG, with significant operations in the US, are benefiting from the expansion of AI data centers and semiconductor factories, which shield them from some tariff impacts. Similarly, companies like Holcim AG in Switzerland are poised for growth due to infrastructure modernization and reshoring of manufacturing in North America.

Looking Ahead: A Glimmer of Hope

Despite the challenges faced by the materials industry in Europe, there are signs of hope on the horizon. Germany’s ambitious investment package could breathe new life into domestic manufacturing, benefiting chemical giants like BASF SE and Evonik Industries AG. The recent surge in German stocks following promises of substantial investments in defense and infrastructure projects underscores the potential for growth and revitalization in the sector.

In conclusion, while the road ahead may be fraught with challenges, there are opportunities for resilience and growth within Europe’s chemicals and steel industry. Adapting to changing market dynamics and leveraging strategic investments will be key to weathering the storm and emerging stronger on the other side. By navigating the complexities of global trade and economic uncertainty, companies in the materials sector can pave the way for a more sustainable and prosperous future.