Rachel Reeves, the Chancellor of the Exchequer, has announced plans to extend the freeze on the personal tax threshold beyond 2028. This move is aimed at generating additional revenue for the government and ensuring fiscal stability in the long term.

The current freeze on the personal tax threshold, which determines the point at which individuals start paying income tax, was initially introduced in 2025 as a temporary measure. However, Reeves has now revealed that she intends to make this freeze a permanent feature of the tax system.

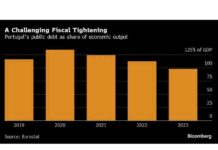

The decision to extend the freeze has been met with mixed reactions. Supporters argue that it is necessary to address the growing budget deficit and prevent an increase in public debt. They believe that maintaining the freeze will help to secure funding for essential public services and infrastructure projects.

On the other hand, critics have raised concerns about the impact of the freeze on low and middle-income earners. They argue that freezing the tax threshold will effectively result in a tax increase for many individuals, putting additional financial pressure on households already struggling to make ends meet.

Reeves has defended her decision, stating that it is a necessary step to ensure the sustainability of the UK’s public finances. She has emphasized the importance of balancing the budget and reducing the deficit to protect the country’s economic future.

In addition to extending the freeze on the personal tax threshold, Reeves has also announced plans to introduce targeted tax breaks for certain industries and businesses. These measures are intended to stimulate economic growth and support job creation in key sectors of the economy.

Overall, the decision to extend the freeze on the personal tax threshold reflects the government’s commitment to fiscal responsibility and long-term financial planning. While the move may be controversial, it is seen as a necessary step to secure the country’s economic future and ensure the stability of public finances for years to come.