Alright, so there’s a lot going on in the global economy this week. Reports are coming in to give us a better understanding of how major economies are dealing with all the trade disruptions. We’re about halfway through Trump’s 90-day break on reciprocal tariffs, and it’s time to see how things are shaping up.

In China, we’re looking at some consumer and industry data on Monday, followed by purchasing manager indexes from around the world on Thursday. These will give us a good idea of how the policy of US levies is affecting growth. The G-7 finance ministers are also meeting in Canada, so depending on whether they can agree on anything, we might get some insight into the fallout from all this trade drama.

The European Commission will be releasing some economic forecasts on Monday, while the European Central Bank will be looking at financial stability a couple of days later. With the recent PMI numbers showing a slowdown in global growth, it’s clear that everyone is feeling the impact of the tariffs.

As for the US, we’ve got some housing data, inflation releases, and a possible interest rate cut in Australia. The Fed policymakers are also making some speeches, so we might get some hints on where rates are heading.

In Asia, there’s a lot of data coming out from China and Japan, along with a rate decision in Australia. The Reserve Bank is expected to make a cut, and we’ll be watching closely for any changes in the growth outlook.

Europe, the Middle East, and Africa are also busy this week. We’ve got some central bank decisions, inflation numbers from the UK, and retail sales data from the euro zone. Italy might also be making some moves, and South Africa is trying to pass a budget.

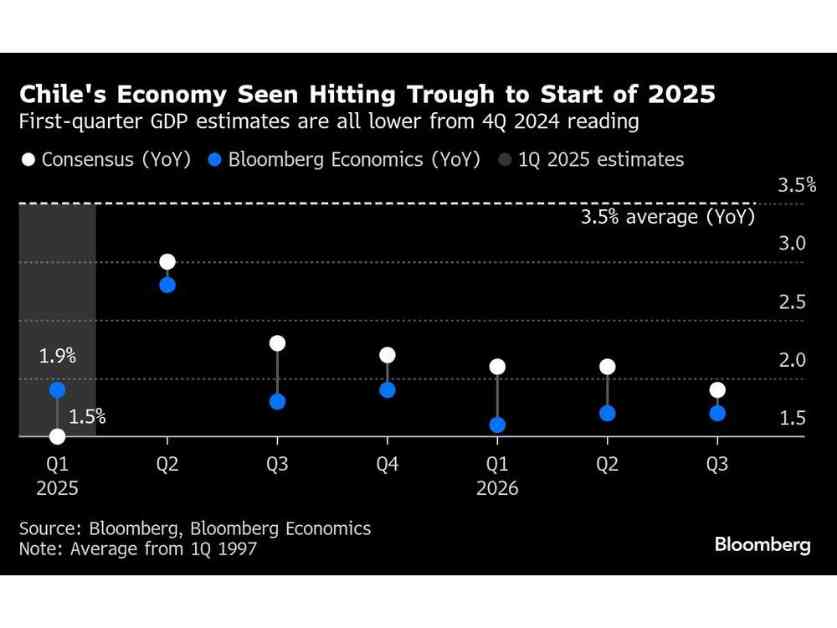

In Latin America, Chile, Brazil, and Argentina are all releasing economic data. Mexico has some inflation and GDP numbers coming out, so we’ll see how things are shaping up down south.

Overall, it’s a packed week with a lot of uncertainty in the air. With trade tensions still high and growth slowing down, it’s not really clear where things are heading. But hey, that’s just the way the economy works sometimes, right?