Federal Reserve Rate Cut Impacts Stocks and Dollar Exchange Rate

In a bold move by the Federal Reserve, the decision to cut interest rates has sent shockwaves through the financial markets, impacting both stocks and the dollar exchange rate. This decision, made in response to economic uncertainties, has left investors and analysts scrambling to assess the implications.

Who, What, Where, When, Why, How

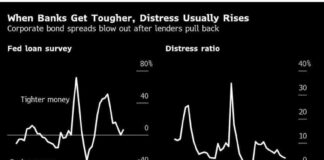

The Federal Reserve, the central banking system of the United States, announced a 0.25 percentage point cut in interest rates, citing concerns about global economic growth and trade tensions. This decision, made during a meeting in Washington, D.C., has significant implications for both domestic and international markets.

Impact on Stocks

The stock market reacted swiftly to the news of the rate cut, with major indexes experiencing fluctuations throughout the day. Investors are closely monitoring the situation, trying to gauge the overall impact on various sectors and industries. Analysts predict that sectors such as technology and healthcare may see significant changes in the coming weeks.

Dollar Exchange Rate

The decision to cut interest rates has also affected the dollar exchange rate, with the U.S. currency experiencing fluctuations against other major currencies. This change in exchange rates has implications for international trade and investment, as businesses adjust their strategies in response to the shifting financial landscape.

Expert Commentary

Financial experts are divided on the implications of the Federal Reserve’s decision, with some praising the move as a necessary step to boost economic growth, while others express concerns about the long-term effects on inflation and market stability. Investors are advised to stay informed and consult with their financial advisors to navigate the changing market conditions.

In conclusion, the Federal Reserve’s rate cut has sent ripples through the financial markets, impacting stocks and the dollar exchange rate. As the situation continues to evolve, investors and analysts must remain vigilant and adaptable to navigate the challenges and opportunities that lie ahead.