European gas traders are making bold moves in the market, betting on a summer surge in prices by nearly 50% as they anticipate a supply shortage in the upcoming months. This unexpected shift in trading behavior is challenging the traditional trend of valuing winter gas higher than summer gas, reflecting a strong belief that prices are poised to rise further amidst concerns of tightening supply. Investment funds are actively engaging in bullish wagers on Intercontinental Exchange Inc., reaching near all-time highs, while fears of disrupted shipping routes due to trade conflicts are adding an extra layer of uncertainty to the already volatile market.

The flurry of bets driving European gas prices to potentially reach €80 ($82.50) per megawatt-hour is a clear indication of the market sentiment. Benchmark futures have already seen a 15% increase since the beginning of the year, hovering around €55 and trading close to a two-year high. This surge in prices is fueled by worries surrounding rapidly depleting inventories, exacerbated by cold weather and low wind power output across Europe, leading to increased gas consumption and reduced storage levels compared to the previous year. As a result, gas for summer delivery is now trading above winter contracts, making early purchases for the next heating season economically unviable.

Experts like Francisco Blanch, a commodity strategist at Bank of America Corp., highlight the current challenges facing European gas traders. The backward curve in Europe’s market, coupled with regulatory requirements to maintain storage levels at 90%, is limiting the value of storage and driving traders away from stockpiling. To navigate this complex landscape, traders are turning to alternative strategies like leveraging price volatility to create value in storage.

The reliance on volatile LNG imports has further complicated Europe’s gas market dynamics, especially after the cessation of Russian pipeline flows through Ukraine earlier this year. This disruption has led to higher regional prices and increased energy costs, posing additional hurdles to stockpiling efforts during the warmer months. Moreover, coinciding stockpiling season with maintenance activities at gas facilities in Norway, one of the region’s primary gas suppliers, has heightened concerns about storage levels and supply security.

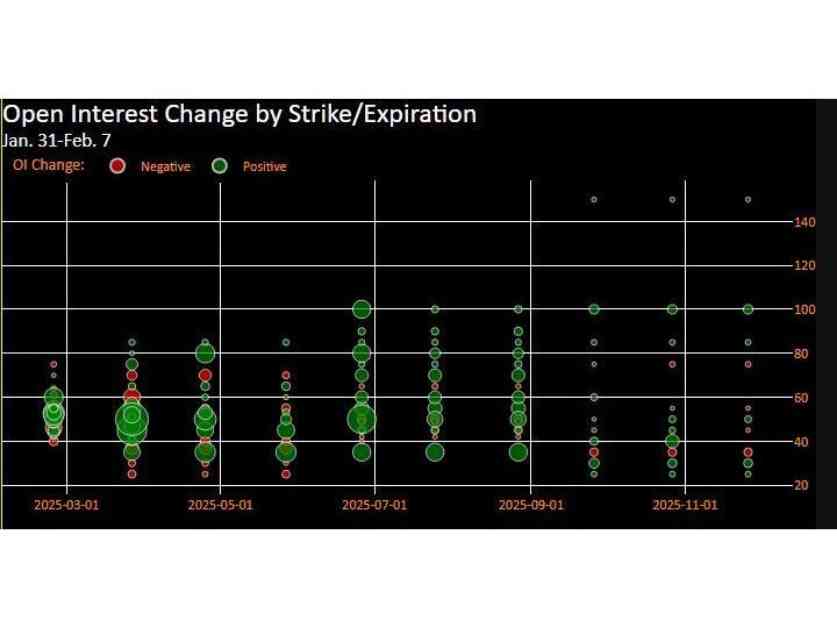

In response to these challenges, European traders are engaging in unprecedented trading activity, with notable trades including call spreads, butterflies, and call options signaling a bullish outlook on gas prices. The volume of these trades is significantly higher than usual, indicating a shift in market sentiment and a growing appetite for risk among traders. As trading volumes for natural gas and other commodities remain elevated globally, experts like Darwei Kung, head of commodities at DWS Group, note a shift in focus among commodity trading advisors towards commodities like natural gas due to their significant price movements and short-term volatility.

While gold and silver may be experiencing lower trading volumes and limited volatility, natural gas has emerged as a favored commodity for short-term trades. The dynamic nature of the gas market, driven by both positive and negative views, presents ample trading opportunities for investors looking to capitalize on price fluctuations. As traders navigate the evolving landscape of global commodities, the unique challenges and opportunities in the natural gas market continue to capture the attention of seasoned investors and industry experts alike.

In conclusion, the European gas market is undergoing a period of heightened activity and uncertainty, driven by supply shortages, regulatory constraints, and geopolitical factors. Traders are adapting to these challenges by exploring new strategies, leveraging price volatility, and capitalizing on emerging trading opportunities. As the summer approaches and demand for gas intensifies, the market dynamics are expected to evolve further, presenting both risks and rewards for investors in the energy sector.