Alamos Gold Unveils Puerto Del Aire Development Plan with 46% After-Tax IRR and Exploration Potential

Alamos Gold Inc. has recently revealed the positive results of an internal economic study conducted on its Puerto Del Aire (“PDA”) project in Sonora, Mexico. This project is a higher-grade underground deposit located next to the Mulatos open pit, within the Mulatos District. The study outlined an attractive, high-return project with significant exploration upside potential.

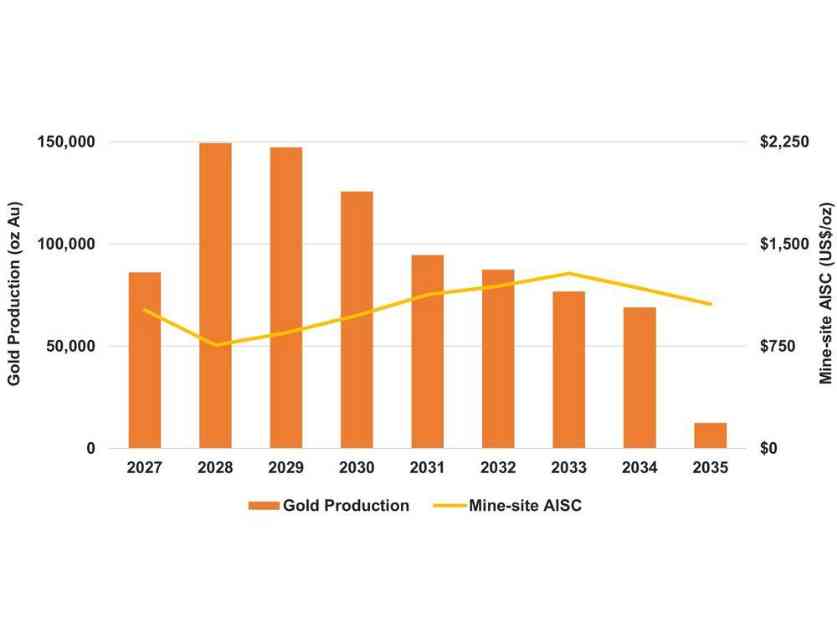

Given the promising economics of PDA and its proximity to existing infrastructure at Mulatos, Alamos plans to commence development in 2025, with production expected to begin in mid-2027. This development is projected to nearly triple the mine life of the Mulatos District, extending production until 2035. The company is currently exploring opportunities that could further extend the mine life and enhance the project’s economics through significant exploration upside potential at both PDA and Cerro Pelon.

Key Highlights of the PDA Project:

– Average annual gold production of 127,000 ounces over the first four years and 104,000 ounces over the current mine life.

– Low cost profile with total cash costs of $921 per payable ounce and mine-site all-in sustaining costs of $1,003 per payable ounce.

– After-tax Internal Rate of Return (“IRR”) of 46% and after-tax Net Present Value (“NPV”) of $269 million at a base case gold price of $1,950 per ounce.

– Payback period of two years at the base case gold price and 1.5 years at current gold prices of approximately $2,500 per ounce.

The project is expected to be funded internally by the strong free cash flow generated at the Mulatos District. Initial capital expenditure is estimated to be $165 million over a two-year period, with total life of mine capital expected to reach $231 million, including $66 million of sustaining capital. The low initial capital intensity of $195 per ounce produced is a positive indicator for the project’s financial viability.

Furthermore, PDA will benefit from the use of existing crushing and mill infrastructure from Cerro Pelon and Island Gold, supporting lower initial capital and reducing project execution risk. The company anticipates that La Yaqui Grande will finance the development of PDA at base case gold prices, after which PDA is expected to generate strong free cash flow.

With PDA located within the existing operation at Mulatos, the project carries lower execution risk. The experienced team in Mexico has a strong track record of building projects on schedule and within budget, including La Yaqui Phase I, Cerro Pelon, and La Yaqui Grande. PDA will be the second underground mine developed and operated in the Mulatos District following San Carlos, further indicating the company’s expertise in underground mining projects.

Additionally, there is significant exploration upside potential at both PDA and Cerro Pelon. Ongoing exploration efforts have extended higher-grade mineralization beyond existing Mineral Reserves and Resources, with the deposit remaining open in multiple directions. High-grade mineralization intersected below the past producing Cerro Pelon open pit presents an opportunity for additional feed to the PDA sulphide mill, potentially extending higher rates of production beyond the initial mine plan.

In conclusion, Alamos Gold’s unveiling of the Puerto Del Aire development plan showcases a compelling project with strong economics and substantial exploration potential. The company’s strategic approach to development and exploration underscores its commitment to long-term growth and value creation in the mining sector.