China has implemented significant cuts in steel production in response to concerns over decreased demand in the industry. The move comes as Chinese steelmakers face challenges due to a collapse in margins and weak market conditions.

Steel production in July saw a drastic decline of about 9% compared to the previous month and the same period last year, totaling 82.94 million tons. This marks the lowest production figure reported in 2024. Over the first seven months of the year, total steel production stood at 613.72 million tons, down by 2.2% compared to the same period last year.

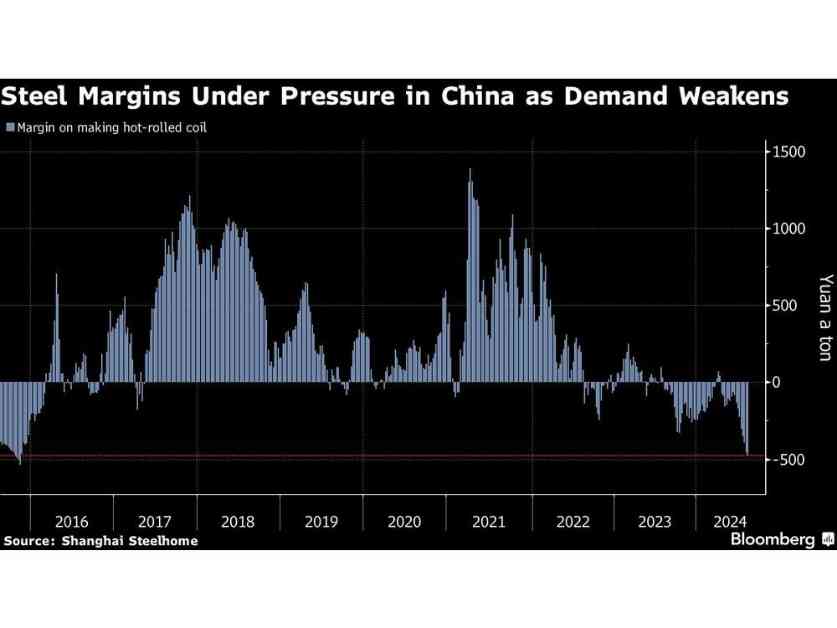

The ongoing downturn in the real estate market and reduced factory activity have led to a sharp decline in domestic steel prices. This has resulted in an influx of Chinese steel into global markets, further exacerbating the situation for steelmakers. The top steelmaker in China has issued warnings that the industry is facing a crisis more severe than previous downturns in 2008 and 2015.

Analysts predict that steel production is likely to decrease even further in August as market sentiment remains bearish. Despite mills across the industry operating at a loss, steel prices show no signs of stabilizing. The construction sector, a major consumer of steel, has been struggling due to sluggish new home sales and increasing foreclosures, leading to a lack of demand for steel.

The Chinese government has been hesitant to increase infrastructure spending to offset the weakness in the steel industry. As a result, Chinese steel consumption is expected to decline by as much as 3% in 2024, following a similar contraction seen last year.

In an effort to address overcapacity and reduce emissions, Beijing has been working to cap steel production at or below the previous year’s level. This task may be easier this year as mills are forced to implement supply discipline in order to improve their margins. This could provide some relief to countries grappling with the impact of cheap Chinese steel exports on their domestic markets.

The challenges faced by the steel industry are mirrored in other sectors, such as oil refining. Slowing growth, the property crisis, and the shift towards clean energy have all contributed to a significant drop in profits for Chinese oil refiners. Refining rates have declined, with output falling by 6.1% year-on-year in July.

Additionally, thermal power generation has decreased for the third consecutive month, while growth in wind and solar output has slowed. Aluminum production, on the other hand, reached a record high for the third straight month, driven by increased production in hydro-rich regions.

Looking ahead, concerns over global supply outpacing demand have led to a decrease in iron ore prices, with major miners increasing exports just as Chinese steelmakers reduce output. The Chinese economy has shown signs of weakness, with slow consumption and disappointing investment impacting growth.

Overall, the steel industry in China is facing significant challenges due to decreased demand and market conditions. The implementation of production cuts is a response to these challenges, with the hope of stabilizing the industry and balancing supply and demand in the global market.