Asian Stocks React to China Factory Data: Market Update

Asian stocks are bracing for a cautious start as China’s factory data indicates ongoing challenges for the country’s economy. Equity futures in Australia and Hong Kong suggest early losses, while Japan and China show slight gains. US contracts remain stable after the S&P 500 closed higher on Friday. The market is also anticipating MSCI index rebalancing and potential Federal Reserve rate cuts.

China’s manufacturing PMI data, due on Monday, will be closely watched following four consecutive months of contraction in factory activity. This signals a struggle for the Chinese economy to meet its growth targets. Additionally, the residential slump in China has intensified, prompting calls for more fiscal easing to support growth. Goldman Sachs economists emphasize the need for fiscal support to achieve the full-year growth target of around 5%.

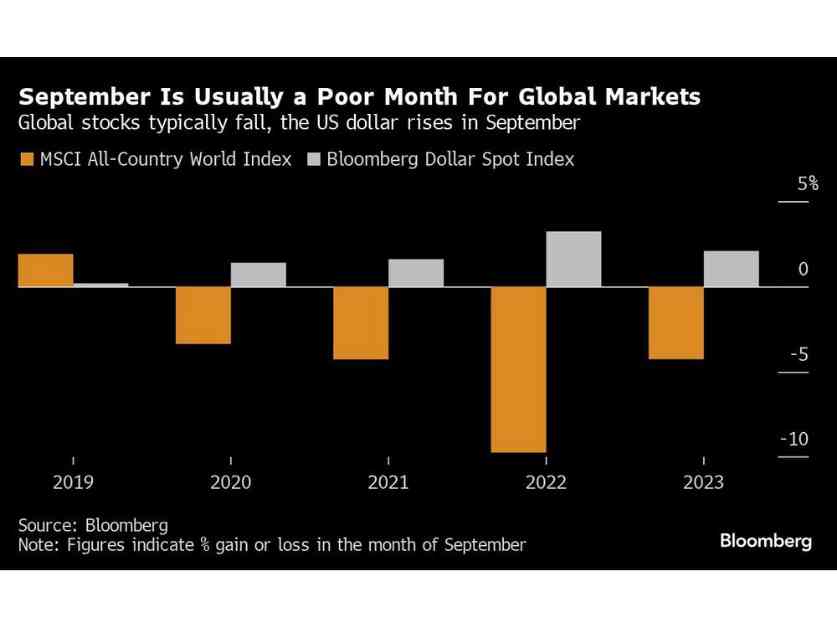

September historically marks a volatile period for global markets, with data showing it to be one of the worst months for stocks in recent years. The dollar typically performs well during this time. The Cboe Volatility Index (VIX) has also seen increases in September over the past three years, indicating potential market turbulence ahead.

The upcoming US jobs report will play a crucial role in guiding the Fed’s decision on rate cuts. The data will also influence the ongoing US election campaign. Traders are already positioning themselves for potential market volatility, with options traders investing millions to protect against a surge in the VIX this month.

US stocks saw gains on Friday, driven by improved consumer sentiment and expectations of Fed rate cuts. Treasury yields rose, and the dollar strengthened as data suggested a more moderate approach to interest rate reductions. The market is currently pricing in a high probability of the Fed beginning an easing cycle this month.

Looking ahead, economic data from Europe, inflation readings from Asia, and central bank meetings in Chile, Malaysia, and Canada will impact market sentiment. The US non-farm payrolls report, scheduled just before Fed Governor Christopher Waller’s final remarks, will provide further insights into the economic landscape.

In currency markets, major currencies remained stable, with the euro, yen, and Australian dollar showing minimal fluctuations. Stock futures for S&P 500, Hang Seng, and Nikkei 225 were mixed, reflecting the cautious sentiment in the market. Cryptocurrencies experienced minor declines, while bond yields and commodity prices remained relatively unchanged.

Overall, the market is bracing for potential volatility in the coming weeks, with a focus on economic data releases, central bank decisions, and geopolitical developments. Investors are closely monitoring the evolving economic landscape and adjusting their strategies accordingly.

By staying informed and adaptable, market participants can navigate the uncertainties ahead and make informed decisions to protect their investments and capitalize on emerging opportunities.