South Korea’s Inflation Slows, Supporting Case for Rate Cut

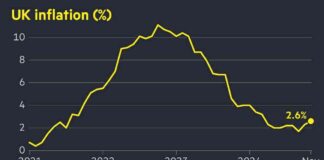

South Korea’s inflation rate has slowed more than expected, signaling the possibility of a policy shift by the central bank in the near future. Consumer prices in August rose by 2% compared to the previous year, a decrease from the 2.6% increase seen in July. Economists had predicted a more modest slowdown to 2.1%. This deceleration can be partly attributed to the comparison with last year, when inflation spiked due to higher energy costs.

The Bank of Korea has been grappling with rising consumer prices fueled by government stimulus efforts during the COVID-19 pandemic. Since early 2023, the central bank has maintained its key rate at 3.5%, describing it as restrictive. The inflation target remains at 2%, and with progress made in curbing price growth, four out of seven board members are now considering a rate cut by the end of the year. While Governor Rhee Chang-yong has not disclosed his stance, many experts anticipate a rate reduction at the upcoming policy meeting on October 11.

In addition to monitoring inflation, policymakers are also closely watching the housing market in Seoul. Property values in the capital have been escalating rapidly, raising concerns about increased household debt and financial vulnerabilities. To address this issue, the government has introduced measures to control housing prices, including plans to boost housing supply and tighten lending regulations. Recent data shows a decline in apartment purchases in Seoul in August, while sales prices continue to decrease.

Dampened consumer spending and lingering credit risks in the construction sector further bolster the argument for a potential rate cut next month. As the Federal Reserve in the US hints at a policy shift, there is growing speculation that the Bank of Korea may follow suit. The convergence of these factors underscores the need for the central bank to reassess its monetary policy stance.

Impact on the Economy

The slowdown in inflation could have far-reaching implications for South Korea’s economy. A potential rate cut by the central bank could stimulate economic growth by making borrowing more affordable for businesses and consumers. Lower interest rates may also incentivize spending and investment, boosting overall economic activity. However, there are concerns that excessive monetary easing could lead to asset bubbles and financial instability in the long run.

Market Response

Financial markets are closely monitoring developments in South Korea’s inflation and monetary policy. The prospect of a rate cut has already influenced investor sentiment, with some anticipating a shift in market dynamics. Stock prices, currency exchange rates, and bond yields may experience fluctuations in response to changes in interest rates. Investors are advised to stay informed about policy decisions and economic indicators to make informed investment decisions.

Government Measures

The government’s efforts to address housing market imbalances and financial risks are crucial in ensuring economic stability. By implementing policies to regulate property prices and strengthen lending standards, authorities aim to prevent a housing bubble and mitigate systemic risks. Collaborative measures between the central bank and government agencies are essential to maintain financial stability and sustainable economic growth.

In conclusion, South Korea’s inflation slowdown presents an opportunity for the central bank to reassess its monetary policy stance. With mounting pressure to support economic recovery and address housing market imbalances, a rate cut may be on the horizon. As policymakers navigate these challenges, collaboration between government entities and proactive measures will be key to fostering a resilient and stable economic environment.