Market Update: Asia Observes US Selloff Following August Crash

Stocks in Asia are bracing for losses as they track the worst day for US benchmarks since the market meltdown on August 5th. Concerns regarding growth and monetary policy have led to a sell-off in risky assets, impacting markets across the globe.

Equity futures in Australia, Hong Kong, and Japan are all pointing towards declines, with the Tokyo bourse expected to see losses of around 3%. US contracts have also dipped in early trading, following a more than 2% drop in the S&P 500, driven by a tech stock plunge led by Nvidia Corp. Additionally, the yen has surged, a key manufacturing indicator has missed forecasts once again, and oil prices have fallen due to worries about weak global demand.

The fear gauge of Wall Street, known as the VIX, has seen a significant increase. Treasury yields have also dropped, with expectations of a sizable half-point rate cut from the Federal Reserve this year. The dollar has strengthened for the fifth consecutive session, marking its longest winning streak since April.

The recent decline in the S&P 500 and Nasdaq 100 at the start of September is the worst seen since 2015 and 2002, respectively. With inflation expectations stable, the focus has shifted to the overall health of the economy, as any signs of weakness could prompt further policy easing. While rate cuts typically benefit equities, a rapid series of cuts by the Fed to stave off a recession may not have the same positive impact.

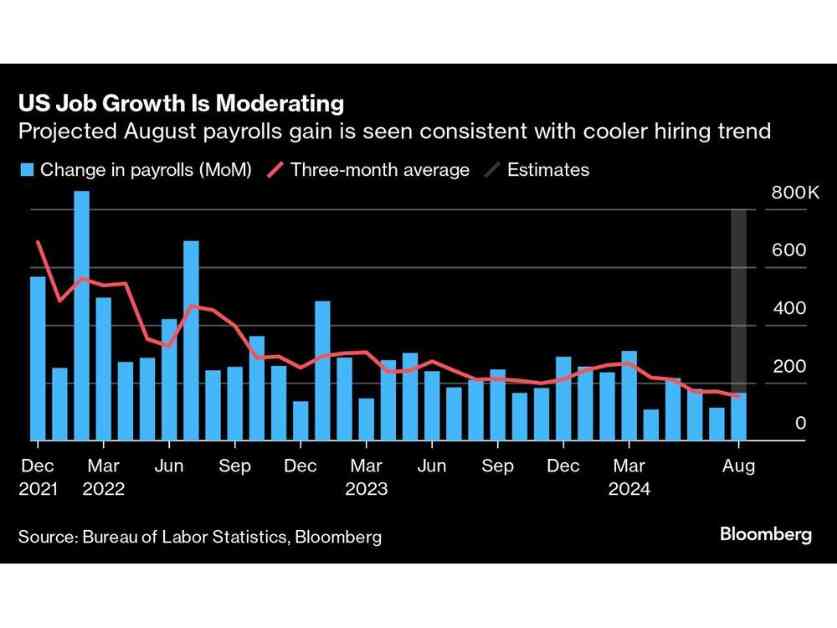

Traders are anticipating that the Fed will slash rates by more than two percentage points over the next year, which would be the most significant drop outside of a downturn since the 1980s. The latest uptick in unemployment has left traders on edge, awaiting Friday’s release of the payrolls data, which will play a crucial role in the Fed’s decision-making process regarding interest rates.

The S&P 500 has fallen to approximately 5,530, while the Nasdaq 100 has seen a decline of over 3%, largely due to Nvidia’s 9.5% drop, resulting in a record one-day wipeout of $279 billion for a US stock. The US Justice Department has issued subpoenas to Nvidia and other companies in an antitrust probe.

US 10-year yields have fallen by seven basis points to 3.83%, and a record number of blue-chip firms have tapped into the corporate bond market to take advantage of lower borrowing costs. The Bank of Japan has reiterated its commitment to raising rates if economic conditions remain stable, leading to a rise in the yen.

As the week progresses, economic data releases will be closely monitored. A recent report showing a fifth consecutive month of shrinking US manufacturing activity highlights the challenges facing the global economy.

Looking ahead, market analysts are closely watching for any signs of resilience in the economy, particularly in the upcoming US jobs report. A stronger-than-expected payrolls number could instill confidence in investors and potentially mitigate growth risks.

Corporate highlights include Boeing Co. facing a downgrade, Vice President Kamala Harris advocating for the domestic ownership of United States Steel Corp., and various shifts in recommendations for major banks. Additionally, the German government plans to reduce its stake in Commerzbank AG, while legal challenges impact Illumina Inc.’s acquisition plans.

Key events scheduled for the week include data releases from China, the Eurozone, Canada, and the US, which will provide further insights into the global economic landscape.

As markets continue to react to evolving economic conditions and policy decisions, investors are advised to stay informed and monitor developments closely to navigate the current volatility effectively.