The European Central Bank is being advised to keep a “steady hand” and not go overboard with rate cuts by Executive Board member Isabel Schnabel. She emphasized the importance of not lowering borrowing costs too much, as inflation may rise in the future. Schnabel expressed her views during a speech at Stanford University, where she highlighted the risks of inflation being tilted towards the upside due to increased fiscal spending and potential cost-push shocks from tariffs.

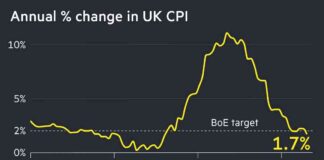

Schnabel cautioned against reacting too hastily to short-term developments, as monetary policy should focus on the medium-term. She pointed out that the current high level of economic uncertainty, combined with fluctuations in energy prices and a stronger euro, could impact headline inflation in the short run. However, she stressed the need to consider long and variable transmission lags before making policy decisions.

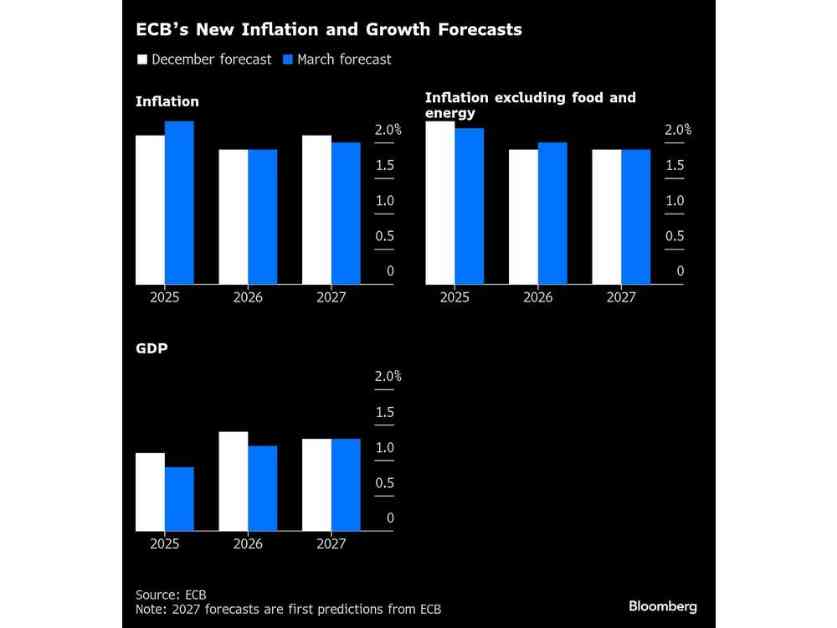

The ECB has already reduced rates seven times since June, with more cuts on the horizon due to trade tensions and global economic uncertainties. Investors are expecting additional rate cuts this year, but Schnabel advised against aggressive easing unless absolutely necessary. She highlighted the potential impact of public spending and global fragmentation on underlying inflation, urging caution in responding to these factors.

In a question-and-answer session, Schnabel discussed the effectiveness of asset purchases as a monetary policy tool, suggesting that they may have been less impactful than initially anticipated. She emphasized the importance of maintaining current interest rates to avoid pushing the economy into expansionary territory prematurely. Schnabel also mentioned the need to closely monitor labor market conditions and inflation expectations before considering further policy adjustments.

Overall, Schnabel’s remarks underscore the ECB’s cautious approach to monetary policy in the face of evolving economic conditions. While uncertainties remain, she believes that maintaining a neutral stance on interest rates is the most appropriate course of action for now. By keeping rates steady, the ECB aims to strike a balance between supporting economic growth and ensuring price stability in the medium term.

So, like, maybe it’s just me, but it seems like Schnabel is really trying to drive home the point that the ECB needs to tread carefully when it comes to adjusting interest rates. With so many external factors at play, it’s crucial to maintain a sense of stability and avoid making hasty decisions that could have long-term consequences. In the end, only time will tell how the ECB’s approach will impact the European economy.