So, like, oil prices are kind of all over the place right now. They’re at some 2021 levels or something, which is pretty wild. And then there’s all this copper rushing to the US, leaving Asian and London inventories super low. Plus, it’s like, really hot and dry everywhere, which is great news for US farmers but not so much for the folks in Europe.

I guess there are five key charts we should be keeping an eye on in the global commodity markets this week. Oil is taking a nosedive under Donald Trump’s second term, thanks to the whole US-China trade war mess. OPEC+ leader Saudi Arabia seems cool with low prices sticking around for a while, which is a major bummer. Traders are gonna be watching to see how much the cartel is gonna crank up output in the long run.

Oh, and copper is just pouring into the US like there’s no tomorrow. Over 170,000 tons showed up in April, as traders try to dodge potential tariffs. This whole situation is tightening up the physical market, with stockpiles dropping like crazy in Shanghai and London. Mercuria Energy Group is saying this copper rush could totally drain global supplies and send prices through the roof.

Then there’s the US Department of Agriculture updating us on spring planting progress and crop conditions. The super hot and dry weather is letting farmers plant like there’s no tomorrow, but some areas are facing serious drought and worries about smaller crop yields. We’ll also be keeping an eye on the weather forecast, ’cause it’s looking pretty dry up north.

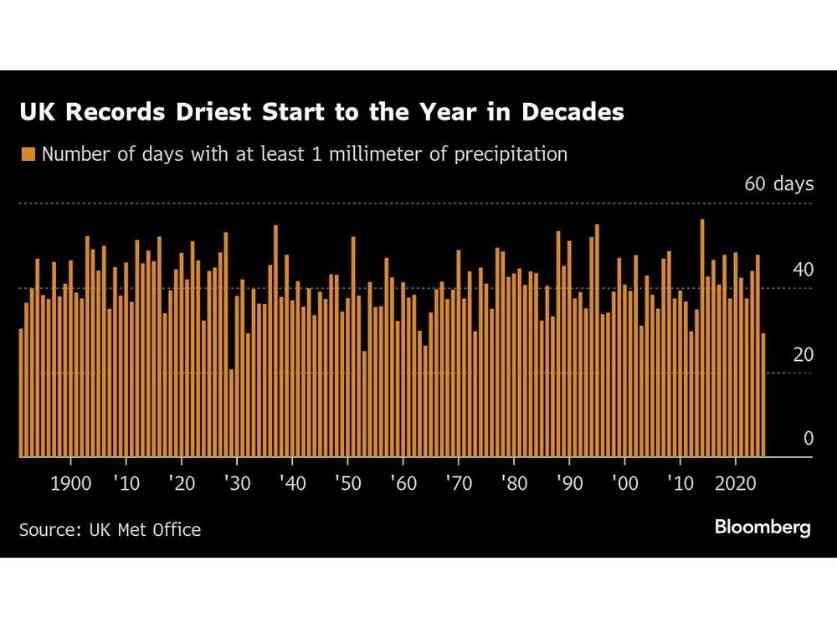

Over in the UK, things are getting pretty toasty after the driest start to the year in like forever. Grain crops are in trouble, and wildfires are becoming a real threat. It’s been crazy dry with hardly any rain in March, and the Met Office is saying it’s been the driest in ages. Even India and the United Arab Emirates are dealing with scorching temperatures.

And let’s not forget about Germany, where power prices went negative because of a huge surge in solar energy and a drop in demand. It’s like 99% green energy powering the country, which is pretty amazing. They’re planning to add a ton more solar capacity in the coming years and kick fossil fuels to the curb.

So yeah, things are kind of all over the place in the global commodity markets. Oil prices are down, copper is up, and the weather is playing a huge role in everything. Who knows what’s gonna happen next? But hey, that’s all part of the fun, right?