In the midst of the ongoing stock market turmoil fueled by President Donald Trump’s trade policies, a unique investment strategy has emerged as a rare winner – the stagflation trade. This approach involves betting on specific stocks that tend to perform well in an economy plagued by stagflation, where inflation rises while economic growth stagnates. While many investors are grappling with losses, this strategy has shown significant gains, offering a glimmer of hope in turbulent times.

Goldman Sachs Group Inc. has devised a basket that focuses on commodities and defensive sectors such as healthcare, while shorting consumer discretionary stocks, semiconductors, and unprofitable tech companies. This approach has proven to be highly successful, outperforming the broader S&P 500 Index by a considerable margin. As of the latest data, the basket has surged nearly 20%, contrasting sharply with the 5.3% decline in the S&P 500.

Expert Insights on Stagflation

Julian Emanuel, the chief equity & quantitative strategist at Evercore ISI, warns of the potential consequences of prolonged tariffs on economic growth and inflation. He emphasizes that sustained tariffs could lead to slower growth and higher inflation, a recipe for stagflation. This scenario could trigger a bearish market outlook, with the S&P 500 potentially plummeting to 5,200 by year-end.

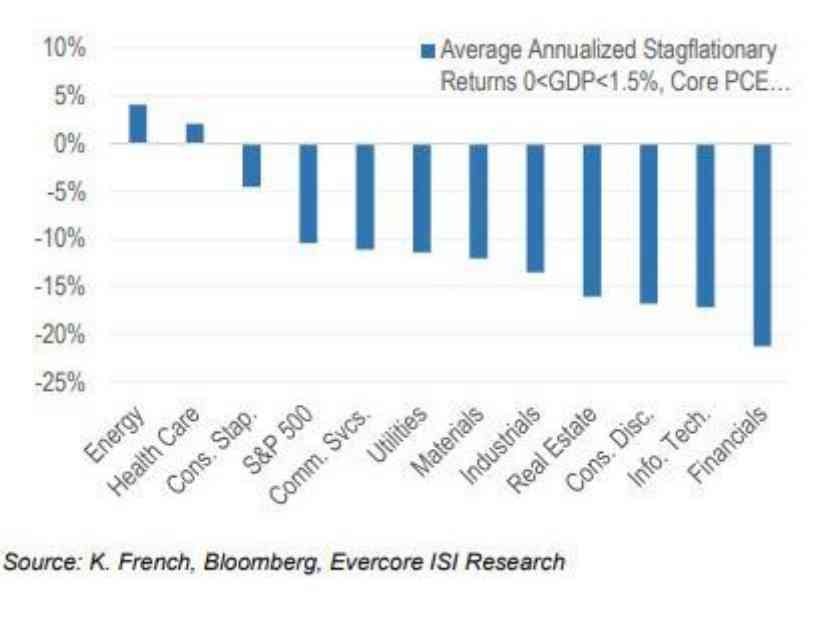

According to Evercore ISI, stagflation is characterized by GDP growth below 1.5% annually and inflation surpassing 3%. This challenging economic environment has prompted a wave of downgrades in economic forecasts, with prominent economists revising their projections downward. Goldman Sachs economist Jan Hatzius, for instance, has slashed the GDP forecast for 2025 and raised inflation expectations, reflecting the prevailing uncertainty.

Winning Strategies in Stagflation

In times of stagflation, certain sectors tend to fare better than others. Defensive industries like healthcare, energy, and consumer staples have demonstrated resilience in the face of economic headwinds. Companies that boast stable cash flows and can navigate turbulent economic waters often outperform their peers. Experts recommend focusing on firms with established consumer demand and the ability to pass on increased costs to customers.

David Lin, CEO & founder of Linvest21, highlights the potential of utilities and healthcare stocks in a stagflationary environment. His AI-driven portfolio models point to consumer staples giants like Johnson & Johnson and Procter & Gamble as promising investments. Additionally, in the energy sector, companies like NextEra Energy Inc. are well-positioned to capitalize on the growing demand for renewable energy, offering a hedge against economic slowdowns and inflationary pressures.

As investors navigate the uncertainties of the current market landscape, the stagflation trade presents a compelling opportunity to recalibrate portfolios and safeguard against potential risks. By strategically positioning assets in sectors with proven resilience and stable cash flows, investors can weather the storm of economic volatility and emerge stronger in the face of adversity.

This website uses cookies to personalize content and analyze traffic. By continuing to use the site, you agree to the Terms of Use and Privacy Policy.