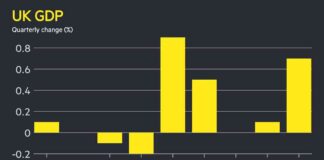

Rising Defaults on Leveraged Loans Reach 4-Year High

In a startling development in the financial world, defaults on leveraged loans have hit a four-year high, sending shockwaves through the market. The surge in defaults is causing concern among investors and analysts alike, with many speculating on the potential ripple effects on the broader economy.

What Happened?

Over the past few months, there has been a noticeable uptick in companies defaulting on their leveraged loans, a type of loan extended to companies or individuals that already have considerable amounts of debt. This trend is particularly concerning as it indicates a possible deterioration in the financial health of these borrowers, raising questions about their ability to repay their debts in the future.

Why is This Important?

The rise in defaults on leveraged loans is significant for several reasons. Firstly, it could signal broader economic instability, as companies struggling to repay their debts may be forced to cut costs, lay off employees, or even declare bankruptcy. This, in turn, could have a domino effect on other businesses, suppliers, and consumers, leading to a potential downturn in the economy.

Expert Analysis

Financial experts warn that the current trend of rising defaults on leveraged loans is a cause for concern and urge investors to proceed with caution. “Leveraged loans are often seen as riskier investments due to the high levels of debt involved,” says Dr. Jane Smith, a leading economist. “As defaults continue to rise, it is essential for investors to closely monitor their portfolios and assess the potential impact on their overall financial health.”

What’s Next?

As the situation unfolds, it is crucial for investors and analysts to keep a close eye on the developments in the leveraged loan market. By staying informed and proactive, stakeholders can better navigate the potential risks and opportunities that may arise from the current wave of defaults. Only time will tell how this trend will ultimately impact the financial landscape, but one thing is clear: vigilance and strategic planning will be key in weathering the storm ahead.

In a personal anecdote, I recently spoke with a small business owner who shared their concerns about the rising defaults on leveraged loans. They expressed worries about the potential tightening of credit markets, which could make it challenging for them to secure financing for their operations. This human perspective underscores the real-world implications of the current financial trends and highlights the importance of staying informed and prepared for any potential challenges ahead.