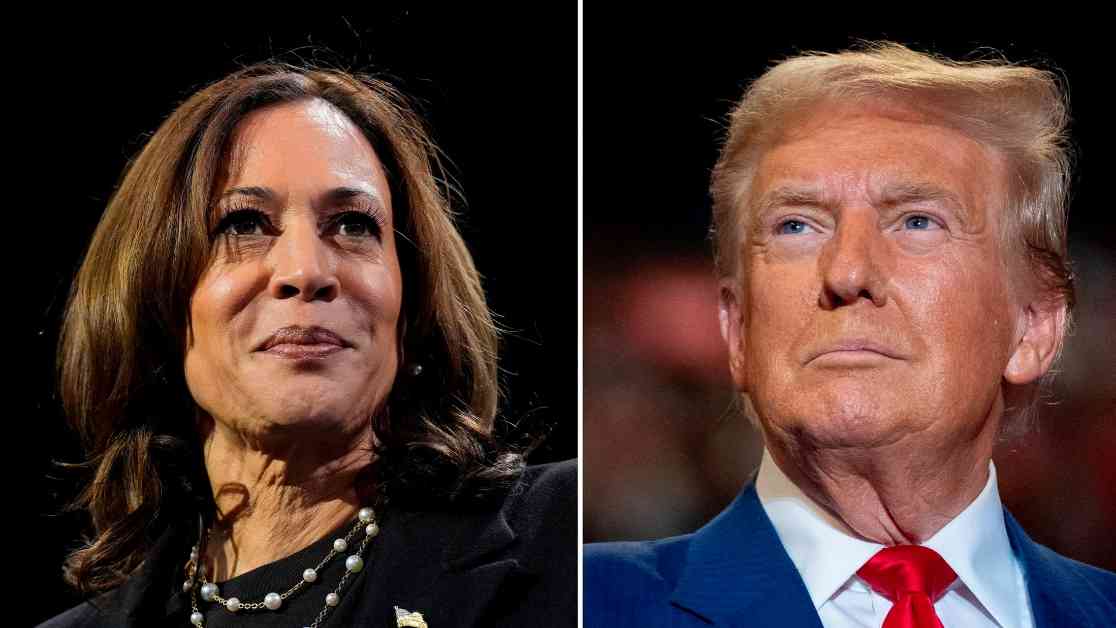

Investors are reconsidering their bets on a Trump victory in the upcoming 2024 US elections, leading to a weakening of the dollar. The uncertainty surrounding the political landscape has caused a shift in the financial markets as investors reassess their strategies.

With the possibility of a different outcome in the upcoming elections, investors are adjusting their positions to mitigate risks and capitalize on new opportunities. This has resulted in a fluctuation in the value of the dollar as market sentiment changes.

The reevaluation of bets on a Trump victory reflects the unpredictable nature of politics and its impact on the economy. Investors are closely monitoring the developments leading up to the elections to make informed decisions about their investments.

In such a dynamic environment, it is crucial for investors to stay informed and adapt to changing circumstances. By keeping a close eye on the political landscape and its potential implications for the financial markets, investors can position themselves to navigate volatility and capitalize on emerging trends.

As the countdown to the 2024 presidential election continues, investors will be closely watching for any new developments that could influence their investment decisions. The shifting dynamics of the political landscape highlight the importance of staying informed and flexible in the face of uncertainty.

In conclusion, the reevaluation of bets on a Trump victory and the resulting weakening of the dollar underscore the interconnectedness of politics and the financial markets. As investors navigate this evolving landscape, staying informed and agile will be key to navigating potential risks and opportunities in the months ahead.