US Inflation Forecast Amid Looming Tariff Risk

As US consumer prices are expected to rise in February, economists are analyzing the pace of inflation and its impact on Federal Reserve policies. The Bureau of Labor Statistics is set to release figures this week, projecting a 0.3% increase in the consumer price index excluding food and energy. While this is slightly lower than January’s 0.4% rise, it signifies ongoing annual price growth.

Core CPI, a key indicator, is anticipated to have risen by 3.2% from last February. This data will influence the Fed’s preferred price gauge, though the official results won’t be available until after the March policy meeting. With a target inflation rate of 2%, interest-rate setters are closely monitoring these numbers.

The latest data on price pressures comes on the heels of a February jobs report that showcased steady payroll growth alongside underlying weaknesses in the labor market. The broader economy is also showing signs of softening, with consumer spending, sentiment, and homebuilding experiencing a decline at the start of the year.

Challenges and Expectations

Following the CPI report, Thursday’s data is expected to reveal similar cost pressures at the economy’s wholesale level. The producer price index, excluding food and fuel, is projected to have increased by 3.5% year-over-year in February. Analysts are keen to see if these trends will prompt any adjustments in Fed rates.

According to Bloomberg Economics, Fed Chair Jerome Powell has highlighted the need for substantial progress in inflation or signs of labor market weakness before considering rate adjustments. After a brief halt in disinflation in January, policymakers are looking for improvements in February’s CPI. Modest growth is expected, with both headline and core CPI inflation estimated to have risen by 0.3%.

Global Economic Implications

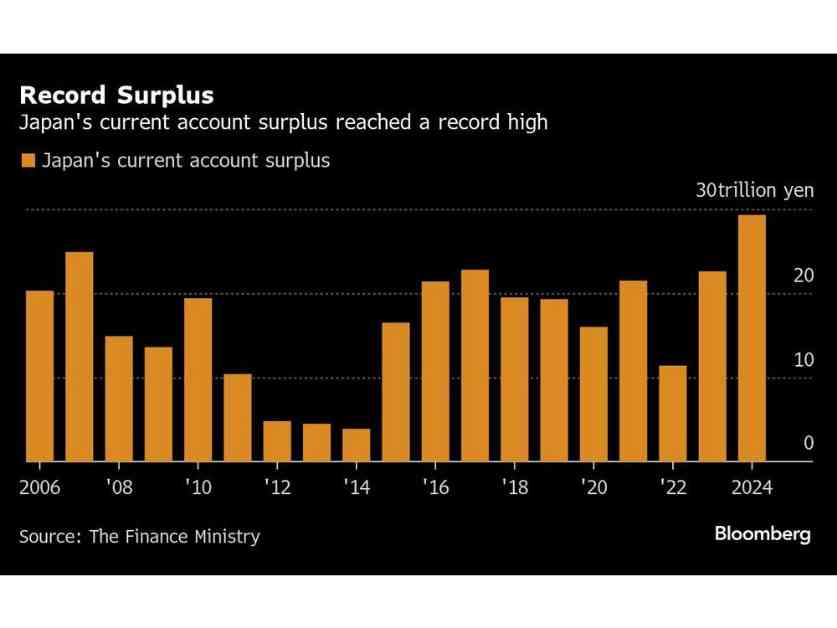

Beyond the US, various countries are grappling with inflation challenges. In Asia, China’s inflation report is anticipated to show a decline in consumer prices, hinting at lingering deflation risks. Japan, Australia, South Korea, and India are among the nations releasing key economic data, from GDP estimates to industrial output figures.

In Europe, policymakers are navigating rate decisions and economic indicators amidst uncertainties. The ECB’s recent rate cut and upcoming speeches by key officials will shape monetary policy discussions. Economic reports from Germany, the UK, Sweden, and Poland will provide insights into industrial performance and inflation trends.

In Latin America, central banks in Argentina and Brazil are monitoring inflation expectations as economic conditions evolve. Key data on industrial production, retail sales, and budget performance will shed light on these countries’ economic trajectories. The region is also seeing shifts in monetary policies to combat rising inflation rates.

As global economies continue to navigate inflation risks and policy decisions, the financial landscape remains uncertain. Analysts and policymakers are closely monitoring these trends to make informed decisions that will shape economic outcomes in the coming months. By staying attuned to these developments, stakeholders can better prepare for potential challenges and opportunities ahead.