European stocks saw a rise on Thursday as investors awaited key US inflation data. The healthcare sector saw gains, particularly after GSK Plc shares surged. The Stoxx Europe 600 Index was up 0.2% in London. GSK announced it will pay up to $2.2 billion to resolve US court cases related to its Zantac medication. Banks also performed well, while the technology sector lagged behind.

In individual stock movements, shares in Italy’s BPER Banca SpA rose after setting new targets for earnings and dividends. Deutsche Telekom AG shares also increased following the announcement of a share buyback program worth up to €2 billion ($2.2 billion) for 2025. However, energy firm Repsol SA saw a slip after a disappointing trading update.

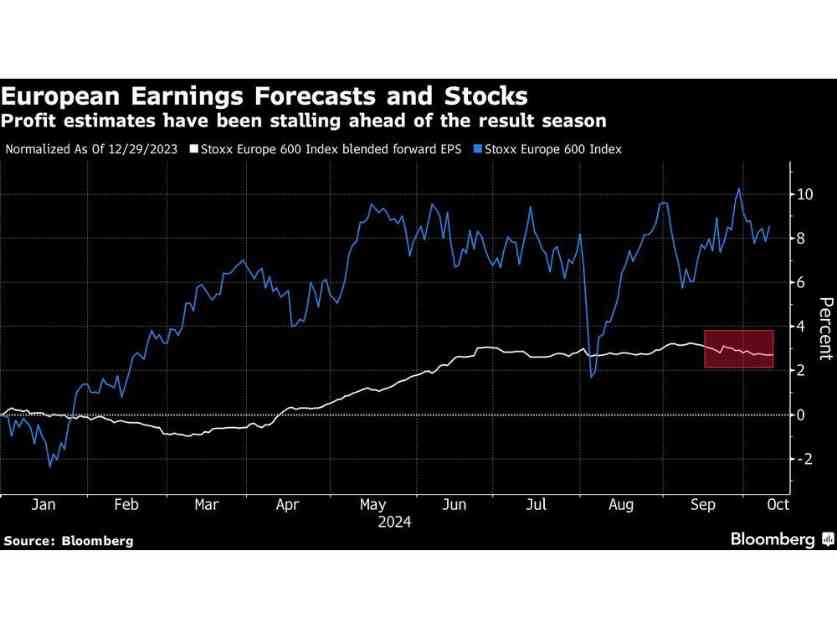

Despite these movements, gains were limited as investors considered various risks. Concerns about escalating tensions in the Middle East and uncertainties surrounding further Chinese stimulus have impacted stock performance. Additionally, investors are gearing up for the upcoming third-quarter earnings season.

Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers, noted the current global market outlook is somewhat gloomy, leading investors to adopt a cautious approach. The Stoxx 600 benchmark has dipped 1.4% since hitting a record high at the end of September and remains slightly negative this month. Traders are closely monitoring the release of US inflation data to gauge future interest rate cuts.

Looking ahead, investors will be keeping a close eye on market developments. The overall sentiment remains cautious due to geopolitical tensions and economic uncertainties. The global market is currently in a wait-and-see mode as investors navigate potential risks.

For more insights on equity markets, investors can explore various resources and stay informed about market trends and developments. Overall, it is crucial to stay updated on market news and be prepared for potential market fluctuations.