Preparing for Potential Federal Reserve Rate Cuts: Global Markets Nervous

The world economy is bracing for significant shifts this week as the United States prepares to embark on an easing cycle. This comes at a time when central banks around the globe are making policy decisions amidst fragile market conditions.

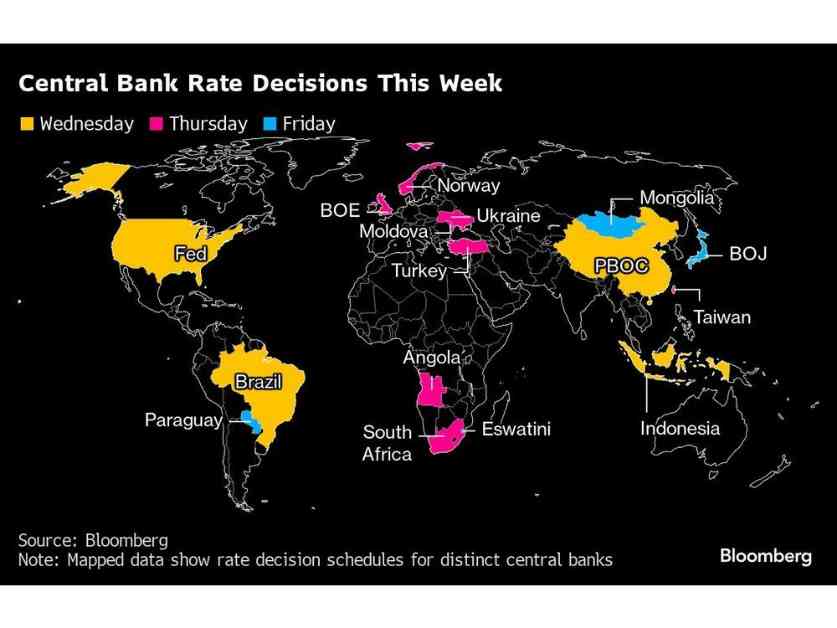

The Federal Reserve is expected to announce a cut in interest rates on Wednesday, kicking off a 36-hour monetary rollercoaster that will culminate in the Bank of Japan’s first meeting following a recent rate hike that triggered a global market sell-off.

Central banks in the Group of 20 and beyond are also poised to adjust their policy levers. Brazil may tighten for the first time in over three years, while the Bank of England faces decisions on its balance-sheet unwind and potential future rate cuts.

In South Africa, policymakers are anticipated to cut borrowing costs for the first time since 2020, while Norway and Turkey may maintain their rates unchanged.

The focus will be on the Federal Reserve’s decision, with traders anxiously awaiting whether a quarter-point cut will be deemed sufficient to support the slowing economy, or if a half-point move will be favored. Clues on the Fed’s future intentions will be closely watched.

Amidst the anticipation surrounding the US announcement, investors will remain on edge until the Bank of Japan concludes its meeting, which is expected to provide insights into the next steps for Japan’s monetary policy.

Market memories of recent volatility during the unwind of carry trades involving the yen will add to the tension. Additionally, China’s monetary policy announcement is awaited following indications of deflationary pressures in the country’s economy.

In the US and Canada, economic indicators on consumer demand, factory output, and housing starts will provide insights into the state of the economy. Inflation readings in Canada are expected to show deceleration, potentially influencing the Bank of Canada’s future rate decisions.

In Asia, the Bank of Japan’s policy decision will be closely watched, along with announcements from China, Indonesia, and Taiwan. Economic data releases in Japan, Singapore, Indonesia, and Malaysia will offer further clarity on the region’s economic performance.

In Europe, the Middle East, and Africa, central bank decisions following the Fed’s easing are anticipated. The Bank of England’s stance on future rate cuts and the pace of its balance-sheet unwind will be of interest, as well as decisions from Norges Bank, Ukraine, Moldova, Turkey, and Angola.

In Latin America, Brazil’s central bank is expected to tighten monetary policy for the first time in years, while economic reports from Colombia and Paraguay will shed light on domestic demand and inflation dynamics.

Overall, global markets are on edge as central banks navigate uncertain economic conditions and geopolitical challenges. The coming week’s decisions and data releases will provide valuable insights into the future trajectory of the world economy.