US Inflation Outlook: Fed Pause Likely After Strong Jobs Data

Underlying US inflation likely experienced a slight cooldown in late 2024 despite a resilient job market and a steadfast economy. This development supports the Federal Reserve’s cautious approach to further rate cuts, signaling a potential pause in monetary policy adjustments.

The consumer price index excluding food and energy is projected to increase by 0.2% in December following four consecutive months of 0.3% growth. Economists surveyed by Bloomberg expect the core CPI, a more accurate measure of underlying inflation, to rise by 3.3% year-over-year, in line with previous months’ data.

### Strong Job Market and Stable Economy

Recent job market data reveals that employers added over a quarter of a million jobs in December, surpassing expectations. The unexpected drop in the unemployment rate further indicates a robust labor market and sustained demand. A consumer survey conducted by the University of Michigan also highlighted a surge in long-term inflation expectations, with 22% of respondents considering purchasing big-ticket items to avoid potential future price hikes.

Economists at major US banks have revised their forecasts for additional rate cuts following the positive job report. The Federal Reserve’s outlook for 2025 includes only two rate reductions, a more conservative stance compared to earlier projections. Recent comments from Fed officials suggest a preference for even greater restraint in monetary policy decisions.

### Expert Insights and Economic Analysis

According to economists at Morgan Stanley & Co., the recent economic momentum can be attributed to increased household net worth, heightened spending on automobiles, and wage growth outpacing inflation. Upcoming reports on retail sales and manufacturing output are expected to confirm robust consumer spending during the holiday season and a potential stabilization of the manufacturing sector.

In the midst of these developments, attention in Canada shifts to US President-elect Trump’s proposed tariffs. Outgoing Prime Minister Justin Trudeau is convening provincial leaders to discuss response strategies, while Energy Minister Jonathan Wilkinson travels to Washington in an effort to mitigate the impending crisis.

### Global Economic Outlook

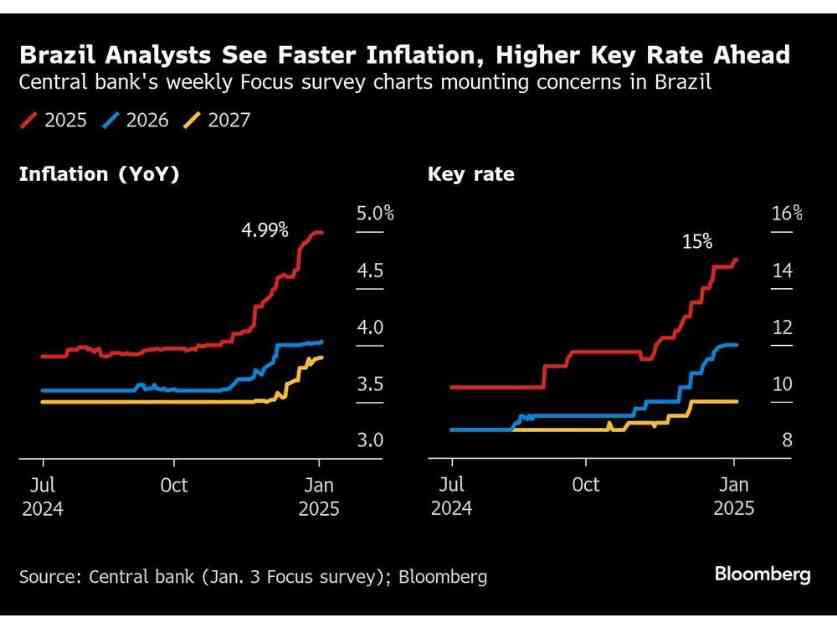

Across the globe, countries like the UK, China, Germany, and Japan are set to release key economic data that will influence market dynamics in the coming weeks. Trade figures from Asia and rate decisions from central banks in Europe, Africa, and Latin America will also shape the global economic landscape.

As the world navigates through shifting inflation rates, trade tensions, and monetary policy adjustments, the interconnectedness of economies underscores the need for strategic decision-making and proactive measures to address emerging challenges.

In conclusion, the nuanced interplay between inflation, job market dynamics, and monetary policy decisions underscores the complexity of managing economic stability amidst evolving global conditions. Stay tuned for the latest updates and expert insights as we navigate the intricate web of economic indicators shaping our financial landscape.