US Market Turmoil Boosts Chinese Corporate Debt Amid Economic Uncertainty

The recent chaos in the US market, triggered by tariffs and a dimming economic outlook, has led to an unexpected turn of events—Chinese corporate debt is now emerging as an appealing investment option. Just a few months ago, many credit managers considered Chinese corporate debt to be uninvestable. However, the tides have turned, and the appeal of Chinese corporate debt is on the rise.

Winnie Cisar, the global head of strategy at CreditSights, highlighted this shift in sentiment on the Credit Edge podcast. She noted, “There’s been a lot more focus on China. The US seems to be sneezing an awful lot lately, and the rest of the world is saying: Well, how do we mask up and try to defend ourselves against this?”

A Rollercoaster Ride in the Financial Markets

The US high-yield credit markets initially soared after Donald Trump’s presidential election victory, driven by optimism surrounding economic stimulus and deregulation. However, the escalating trade war fears shattered this market euphoria, causing US debt to lose its luster. In contrast, Chinese credit has been on a rebound, fueled by fiscal and monetary stimulus measures.

Omotunde Lawal, the head of emerging markets corporate debt at Baring Investment Services, shared insights on this changing landscape. He mentioned, “Investors may be starting to look back at China. It’s still a little bit cheap, given the renewed government focus on technology, a 5% growth target, and the benefits that AI advances can bring to Chinese industrials and consumer companies.”

Chinese Corporates Seize the Opportunity

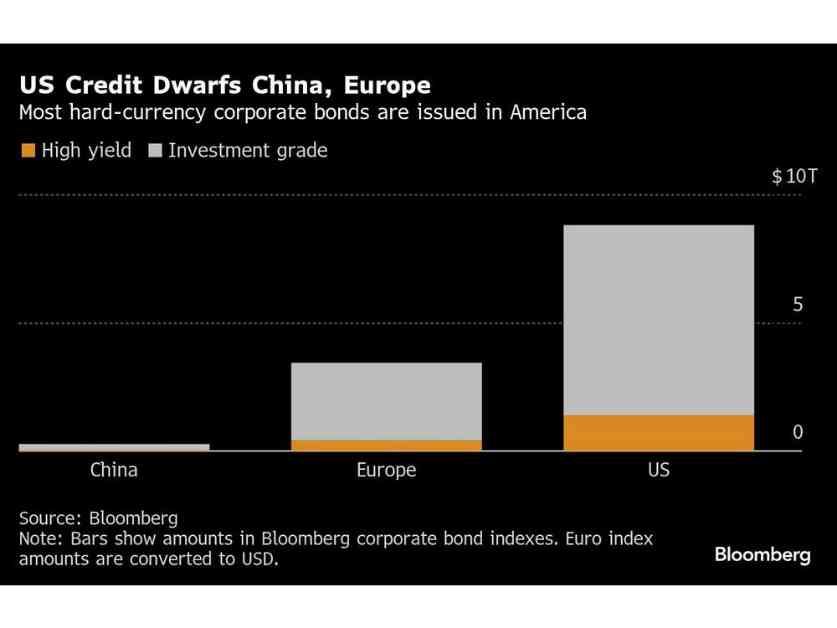

Chinese corporates are capitalizing on this newfound interest, with many raising significant funds in the dollar bond market. In fact, Chinese companies have raised $15 billion in the first few months of this year, marking the most substantial amount for this period since 2022. Even real estate firms, like Beijing Capital Group, are exploring debt-raising opportunities.

Winnie Cisar also highlighted the growing investor interest in Chinese technology firms, citing the recent successful bond issuance by Baidu Inc. These developments signal a shift in investor sentiment towards Chinese assets, despite lingering concerns about trade tensions and economic uncertainties.

Remaining Cautious Amidst Market Volatility

While the appeal of Chinese corporate debt is on the rise, caution remains a prevalent sentiment among investors. Xuchen Zhang, an emerging markets credit analyst at Jupiter Asset Management, expressed concerns about market complacency. Some issuers are trading at single-digit yields without a clear plan to address upcoming maturities, raising red flags for investors.

Moreover, the looming threat of an escalation in the trade wars and potential economic downturns in the US pose significant risks to the Chinese economy. Paul Mackel, the global head of FX research at HSBC Holdings Plc, noted, “It is likely that more tariffs or other actions could be announced after the US administration finishes its various reviews on China’s trade. Tariff-induced depreciation pressure on the renminbi is, therefore, still very high.”

Navigating Uncertainty in Global Markets

As the global financial markets navigate through turbulent times, the allure of Chinese corporate debt shines brightly against the backdrop of US market turmoil. While challenges and risks persist, the evolving dynamics between the US and China are reshaping investment opportunities and market sentiments worldwide.

In conclusion, the interplay between geopolitical uncertainties, trade tensions, and economic outlooks continues to influence investors’ decisions and reshape the global financial landscape. As we brace for further developments in the US-China trade relations, the resilience and adaptability of investors will play a pivotal role in navigating the complexities of today’s interconnected markets.