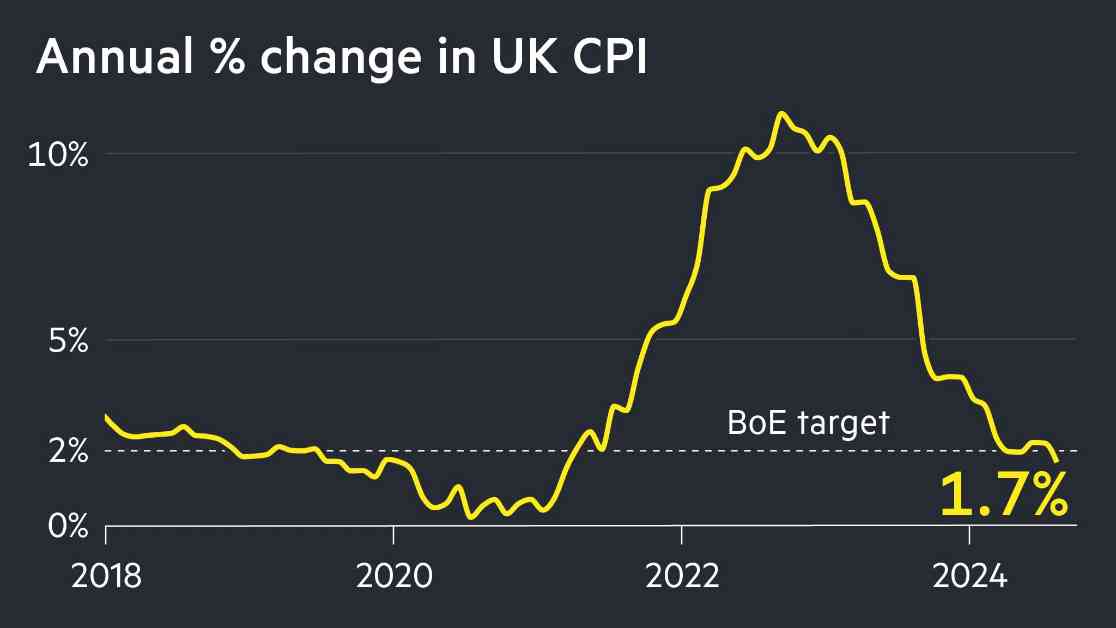

The UK inflation rate has dropped to 1.7%, causing the value of the pound to fall. This decrease in inflation means that prices for goods and services are rising at a slower pace than before. The weakening of the pound can have various effects on the economy, including making imports more expensive and potentially leading to higher costs for consumers.

Inflation is an important economic indicator that measures the rate at which prices are increasing. A lower inflation rate can be a sign of slowing economic growth, as businesses may be facing weaker demand for their products and services. It can also indicate that there is less pressure on the Bank of England to raise interest rates in order to control inflation.

The decrease in inflation may be welcomed by consumers, as it could mean that their purchasing power is not being eroded as quickly. However, it can also have negative effects, such as reducing the value of savings and pensions. For businesses, lower inflation may mean that they have less room to increase prices and improve their profit margins.

Overall, the decline in UK inflation to 1.7% is a significant development that could have wide-ranging implications for the economy. It will be important to monitor how this trend evolves in the coming months and what actions policymakers may take in response to it.