When Vice President Kamala Harris and former President Donald Trump took the debate stage in Philadelphia on Tuesday night, they arrived armed with a stockpile of talking points about the U.S. economy. In the weeks leading up to their head-to-head debate, hosted by ABC News, both Harris and Trump unveiled new economic proposals and tried to paint their rival as a threat to the health and stability of the U.S. economy. As the candidates tried to frame the economy in favorable terms, several key numbers were highlighted to provide context and insight into the state of the economy.

Inflation and Prices

Inflation and prices play a significant role in shaping the economic landscape, impacting consumers, businesses, and overall economic growth. Understanding key inflation numbers can provide valuable insights into how the economy is performing and what challenges it may be facing.

– **1.4%**: The Consumer Price Index in January 2021 at the start of the Biden-Harris administration. President Joe Biden has repeatedly claimed that he inherited a 9% inflation rate from Trump, which is false.

– **9.1%**: The CPI in June 2022, the height of the post-pandemic inflation surge under Biden, and the highest rate since 1981. Trump has repeatedly claimed it was the highest inflation rate in U.S. history, but this is false.

– **2.9%**: The annual CPI in July of this year, the most recent reading. This is the lowest 12-month inflation rate since March 2021. The next CPI report will be released Wednesday.

– **19.4%**: The cumulative increase in prices since Biden and Harris took office, according to a CNBC analysis of CPI data. Trump has falsely claimed that cumulative prices have soared more than 50% since January 2021.

– **7.8%**: The cumulative increase in prices over the four years Trump was in office, according to a CNBC analysis of CPI data over time.

These inflation numbers provide a snapshot of how prices have evolved over time and the impact on consumers and businesses. It’s essential for policymakers to address inflation concerns to ensure a stable and healthy economy for all.

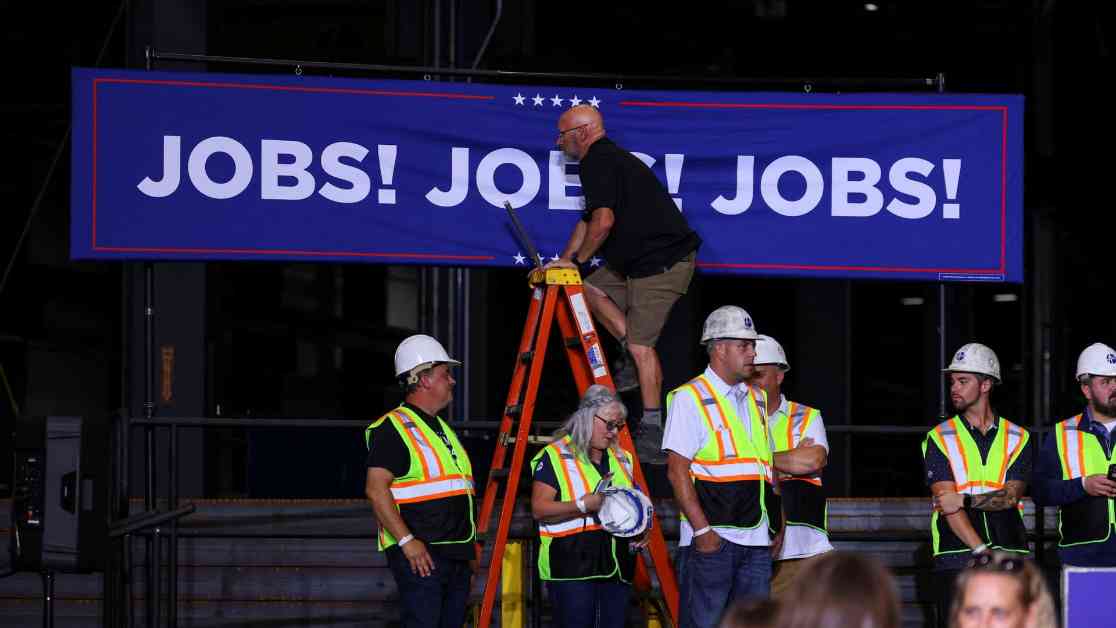

Jobs and Wages

Employment and wages are critical indicators of economic health, reflecting the job market’s strength and workers’ financial well-being. Examining key job and wage numbers can shed light on the economy’s performance and the challenges facing the workforce.

– **14.8%**: The unemployment rate in April 2020, the highest single month of the Trump administration, when employers hemorrhaged jobs due to Covid-19. This was also the highest monthly rate since the BLS first began tracking unemployment in 1948.

– **6.4%**: The unemployment rate in January 2021, when Biden and Harris took office. This was the highest monthly rate of the Biden-Harris administration so far.

– **17.6%**: The average hourly wage increase since Biden took office, according to a CNBC analysis of BLS data. Biden claims that wage growth outpaced inflation during his presidency, which is not true since prices have cumulatively increased by 19.4%.

– **15.9 million**: The jobs created under the Biden-Harris administration so far, according to BLS data.

– **2.7 million**: The net number of jobs lost during the Trump administration, a figure largely attributable to the pandemic-induced economic recession.

– **6.7 million**: The jobs added from the time Trump took office in January 2017 until February 2020, just before the pandemic tanked the U.S. job market.

These job and wage numbers reflect the changing dynamics of the labor market and the efforts of policymakers to stimulate job creation and wage growth. Addressing unemployment and wage disparities is crucial for fostering economic prosperity and reducing inequality.

Deficits, Spending, and Debt

Government spending, deficits, and debt levels are critical components of the economic landscape, shaping fiscal policy decisions and long-term economic stability. Examining key deficit, spending, and debt numbers can provide insights into the government’s financial health and its impact on the economy.

– **$8.4 trillion**: The estimated net total spending by the Trump administration. This figure represents the amount Trump approved in gross ten-year borrowing, minus the amount he approved in deficit reduction, according to the nonpartisan Committee for a Responsible Federal Budget. If Covid-19 stimulus and relief packages are removed from the total, that number drops to $4.8 trillion.

– **$4.3 trillion**: The estimated net total spending during Biden’s first three years and five months in office, per the CRFB. Without the American Rescue Plan, Biden’s major pandemic stimulus package, the net total falls to $2.2 trillion.

– **39.1%**: The percent increase of the U.S. national debt from Trump’s inauguration until the day of Biden’s inauguration, according to a CNBC analysis of figures from the Congressional Research Service.

– **30.6%**: The percent increase in U.S. national debt from Biden’s inauguration day until this month, according to a CNBC analysis of Treasury data.

These deficit, spending, and debt numbers underscore the government’s financial obligations and the challenges of balancing budgetary priorities with long-term fiscal sustainability. Managing deficits and debt levels responsibly is crucial for ensuring economic stability and future prosperity.

GDP

Gross Domestic Product (GDP) is a key indicator of economic performance, measuring the total value of goods and services produced within a country’s borders. Analyzing GDP growth rates can offer valuable insights into the overall health and trajectory of the economy.

– **2.7%**: The average annual growth rate of U.S. GDP from 2017 to 2019, the first three years of Trump’s presidency before the Covid-19-induced economic crash, according to World Bank data.

– **3.4%**: The average U.S. annual GDP growth rate from 2021 to 2023, the first three years of the Biden-Harris administration. This number was boosted by a hot 2021, stoked in part by the slew of pandemic-era stimulus packages passed by both Trump and Biden.

These GDP growth numbers reflect the economy’s resilience and recovery efforts following the Covid-19 pandemic. Sustaining robust GDP growth is essential for fostering economic prosperity and ensuring long-term sustainability.

Stock Market

The stock market serves as a barometer of investor sentiment and economic outlook, reflecting market trends and expectations. Examining key stock market performance indicators can provide insights into market dynamics and investor confidence.

– **12.3%**: Average return of the S&P 500 from 2021 to 2023, the first three years of the Biden-Harris administration, according to figures from Berkshire Hathaway.

– **16.3%**: Average return of the S&P 500 from 2017 to 2019, the first three years of the Trump White House.

These stock market return numbers highlight the market’s response to policy decisions, economic conditions, and global events. Monitoring stock market performance is crucial for understanding investor sentiment and its implications for the broader economy.

In conclusion, as Vice President Kamala Harris and former President Donald Trump engaged in a debate on the U.S. economy, a range of key numbers provided valuable context and insights into economic performance, challenges, and policy implications. Understanding these key economic indicators is essential for policymakers, businesses, and the public to make informed decisions and shape the future trajectory of the economy.