A New Era in Energy Trading: AI Weather Models Transform the Market

In the heart of Bologna, Italy, a former tobacco factory hums with activity every midnight as supercomputers whir to life, processing millions of data points to forecast the Earth’s weather. Six hours later, energy traders across Europe eagerly await the latest updates from this European forecasting center. These forecasts are not just any predictions – they are the lifeblood of the energy trading industry, dictating when and where to move energy resources on the grid. However, a new player has entered the game: an AI-powered weather model that threatens to revolutionize the way traders operate.

The European forecasting center’s groundbreaking AI model, a first of its kind, leverages historical data in addition to real-time measurements to provide more accurate predictions than ever before. Released just last month, this innovative approach has already proven its superiority over traditional methods in forecasting temperature, precipitation, wind, and tropical cyclones. With less computing energy required, the AI model is poised to empower traders to navigate the volatile energy markets affected by climate change, geopolitics, and renewable energy fluctuations.

Expert Insights: The Impact of AI on Energy Trading

Daniel Borup, CEO of Danish trading firm InCommodities A/S, attests to the transformative power of the European center’s AI model. He emphasizes that the ability to update information more frequently leads to improved predictions, ultimately enhancing energy distribution efficiency. This sentiment is echoed by industry experts who recognize the potential of AI to streamline decision-making processes and optimize resource allocation in the face of evolving market dynamics.

Forecasting the Future: AI’s Role in Market Volatility

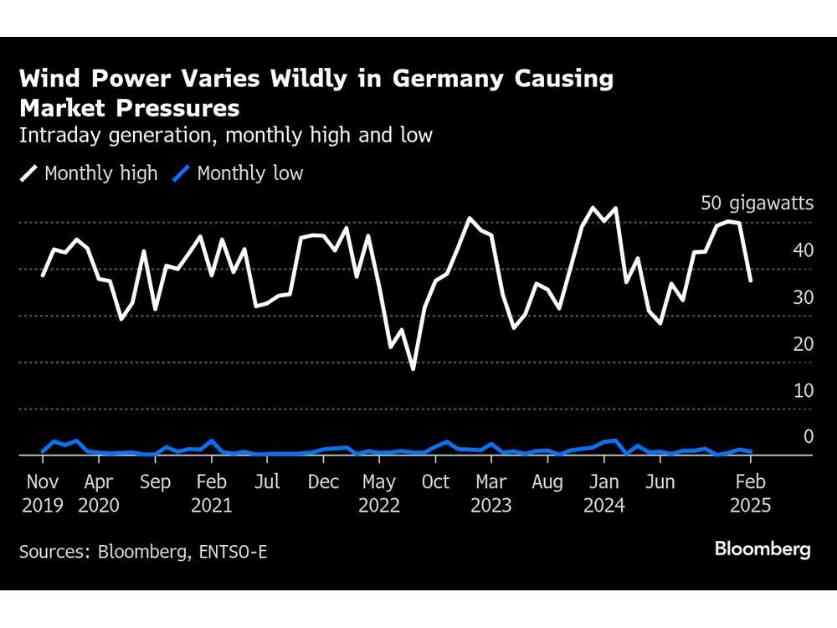

The AI weather model’s enhanced accuracy comes at a critical time for energy markets grappling with extreme weather events and shifting renewable energy landscapes. By providing advanced insights into temperature, wind speeds, and solar power up to two weeks in advance, the model equips companies and policymakers with the tools to respond swiftly to changing conditions. This agility is essential in managing market volatility, as demonstrated by recent fluctuations in power prices driven by solar park generation in Germany.

Florian Pappenberger, Deputy Director-General of the European forecasting center, underscores the significance of AI in addressing the Big Data challenges of weather and climate forecasting. By harnessing machine learning techniques, the center’s AI model accelerates the forecast generation process, enabling rapid responses to weather-related events that impact energy markets worldwide. As industries increasingly rely on these forecasts for strategic decision-making, the demand for AI-driven insights continues to grow.

As the energy trading landscape evolves, the intersection of AI and meteorology promises to reshape how markets operate in response to weather patterns. While AI models have shown remarkable progress in accuracy and speed, experts caution against viewing them as a panacea for all forecasting challenges. The future lies in a hybrid approach that integrates the strengths of both AI and conventional methods to deliver comprehensive, reliable forecasts for a rapidly changing world.

Evolving with the Times: AI’s Potential in Energy Trading

Looking ahead, the European forecasting center’s roadmap for the next decade highlights AI as a central pillar of its forecasting strategy. With the promise of improved accuracy and efficiency, AI models are positioned to play a pivotal role in shaping the energy trading landscape. By leveraging cutting-edge technologies and collaborations with industry partners, the center aims to enhance its forecasting capabilities and empower traders with real-time insights into weather patterns and market trends.

Rob Hutchinson, a meteorologist at the Swiss weather analytics firm Meteomatics AG, emphasizes the value of AI in providing timely and accurate weather information to energy traders. While AI models continue to refine their forecasting capabilities, Hutchinson underscores the importance of data-driven decision-making and a nuanced understanding of the strengths and limitations of AI technology. By combining the best of both AI and conventional forecasting methods, traders can make informed choices that drive success in a rapidly evolving market environment.

In conclusion, the integration of AI into energy trading represents a significant step forward in leveraging technology to navigate the complexities of modern markets. As AI models continue to evolve and enhance their forecasting capabilities, the energy trading industry stands to benefit from more accurate, timely, and actionable insights that drive innovation and efficiency. By embracing the power of AI in forecasting, traders can stay ahead of the curve and adapt to the dynamic forces shaping the future of energy trading.