Trafigura Group, a major commodities trading company, is making a strategic move in the carbon credits market. They believe that new regulations will drive the market into mainstream emissions accounting. Hannah Hauman, the global head of carbon trading at Trafigura, mentioned that increased regulations are reshaping the carbon credits market, turning it into investment-grade assets.

Carbon credits have been a controversial aspect of climate finance, with allegations of greenwashing causing a slump in the voluntary carbon market. Major companies like HSBC Holdings Plc and Shell Plc have adjusted their plans in response to these challenges. However, regulators in various regions are acknowledging the importance of carbon credits in achieving net-zero emissions targets.

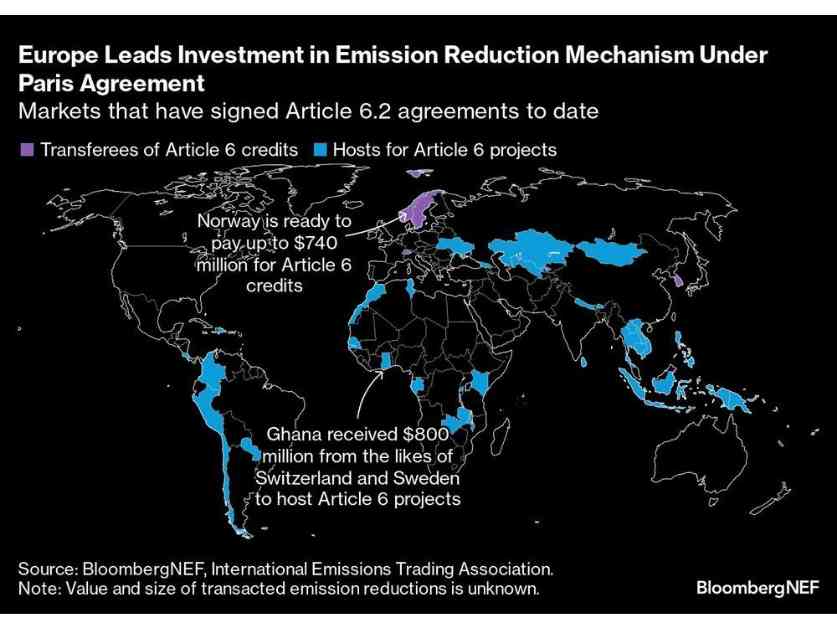

At the recent COP29 summit in Baku, an agreement was reached to advance rules for a new global carbon crediting mechanism under the United Nations. This development is seen as a significant step towards creating a more structured market for carbon credits. However, experts and campaigners are cautious about the potential risks associated with these agreements.

Despite past challenges, Trafigura is gearing up to meet the rising demand for carbon credits by developing new projects. With a clearer regulatory framework in place, companies now have a better understanding of their emissions reduction targets up to 2030. This allows them to plan, price, and procure carbon credits more effectively.

The carbon market is evolving rapidly, driven by policy changes and increasing demand for sustainable investments. Trafigura, as a leading trader of carbon-removal credits, is seizing the opportunities presented by these shifts. They recently announced a substantial investment in a carbon credits project in Africa, signaling their commitment to the growing market.

Overall, the carbon credits market is undergoing a transformation, with new regulations and agreements shaping its future. Companies like Trafigura are adapting to these changes and positioning themselves for growth in the expanding market for carbon credits. As the world moves towards a more sustainable future, the role of carbon credits in mitigating climate change is becoming increasingly crucial.