The Reserve Bank of Australia is expected to maintain its key interest rate at a 13-year high as it deals with slow disinflation and global risks, such as the tight US election. Economists predict that the cash rate will remain at 4.35% until at least February, with the bank’s statement likely to emphasize the need for restrictive policy due to elevated core consumer prices.

Global uncertainties, including geopolitical tensions and the US election, are contributing to the cautious approach of the RBA. The market is also watching China’s economy closely, as it has a significant impact on Australian exports and economic performance.

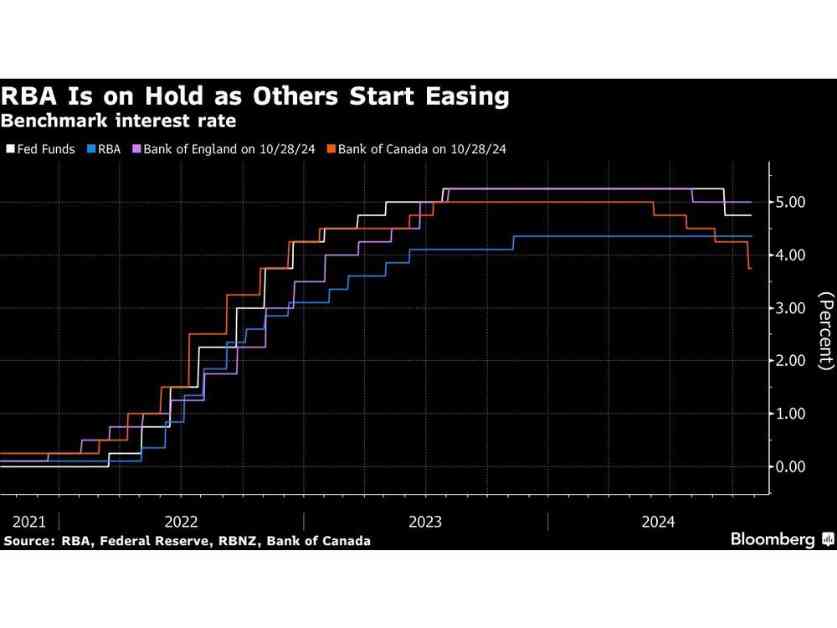

While Australia’s economic growth has been weak, the RBA is not considering rate cuts yet. Governor Michele Bullock has emphasized the importance of inflation reaching the target range of 2-3% sustainably before any rate adjustments are made. When rate cuts do occur, they are expected to be gradual, with the cash rate peaking below that of the Federal Reserve.

The RBA will release updated economic forecasts alongside its decision, with a focus on underlying inflation. The central bank’s August update showed a gradual easing of inflation rates over the next few years. Economists believe that the RBA will maintain a neutral-hawkish bias in its messaging, especially if Australia’s labor market remains strong.

Overall, the RBA’s decision is influenced by both domestic and global factors, and any potential rate cuts may be delayed until May 2025. The upcoming US presidential election and economic indicators will also play a role in shaping the bank’s policy decisions. Australia is also set to hold an election by May 2025, adding to the political and economic landscape that the RBA must navigate.