Oil Prices Fluctuate Amid Supply and Geopolitical Concerns

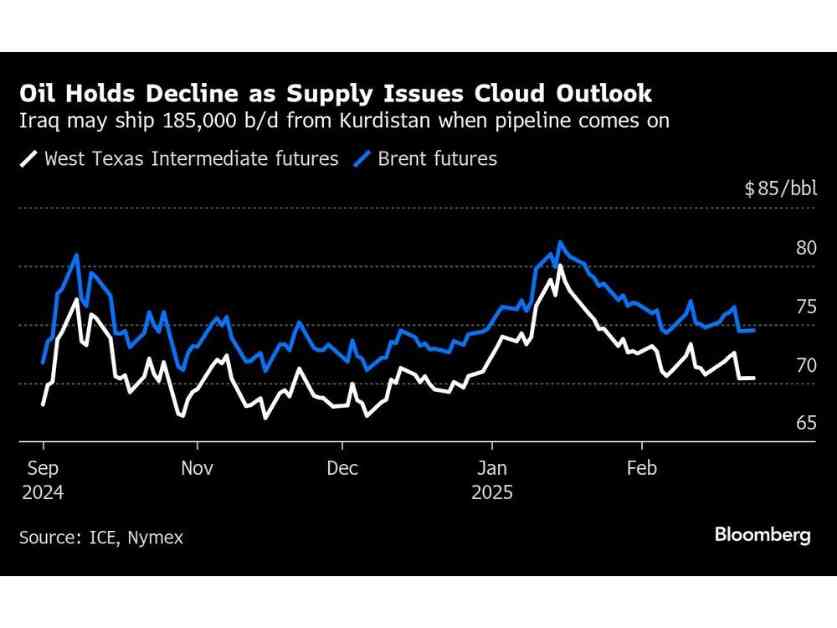

Oil prices are in a state of flux, influenced by both supply issues and geopolitical tensions. The global benchmark Brent managed to stabilize above $74 a barrel after a significant drop of nearly 3% on Friday, while the US marker West Texas Intermediate briefly fell below $70 at the start of the week. The potential increase in oil supply from Iraq has put pressure on prices, as the country may ship 185,000 barrels a day from the Kurdistan region if the pipeline to Turkey resumes operations, according to a deputy Iraqi minister. The timeline for this development remains uncertain.

Ukraine’s President Volodymyr Zelenskiy expressed his willingness to step down if it meant ensuring peace in his country. This comes as US President Donald Trump has initiated talks with Russia and called for elections in Ukraine. A resolution with Moscow could lead to a reduction in sanctions and potentially impact export flows, adding another layer of complexity to the oil market dynamics.

The year 2025 has been a turbulent one for oil prices, with initial gains reversing and wiping out all progress made since the beginning of the year. Trump’s imposition of various tariffs has cast a shadow on global economic growth, while rising US stockpiles and concerns over weakening Chinese demand have added to the uncertainty. Despite these challenges, market indicators are pointing towards a less constrained immediate supply situation, further complicating the outlook for crude oil.

Chris Weston, the head of research at Pepperstone Group, highlighted the prevailing ambiguity in the market, especially regarding the potential ceasefire in Ukraine and its implications for the oil industry. He emphasized the importance of economic data releases, particularly from the US, in guiding the direction of crude oil prices in the near future.

Market Dynamics and OPEC Decision

The prompt spread of West Texas Intermediate (WTI) has been narrowing, indicating a less optimistic market sentiment. The spread between its two nearest contracts stood at 17 cents a barrel in backwardation on Monday, a significant decrease from a month ago. This shift suggests a weakening bullish sentiment among traders and analysts, reflecting the broader uncertainty in the oil market.

In response to the softening market conditions, the Organization of the Petroleum Exporting Countries (OPEC) and its allies are likely to postpone their plans to increase production. A survey of over 70% of traders and analysts revealed expectations that the scheduled monthly production boosts, starting in April, will be delayed. This decision underscores the challenges faced by OPEC+ in balancing supply and demand dynamics amidst a potential surplus in the market.

As oil prices continue to be influenced by a complex interplay of factors, including geopolitical developments and market fundamentals, the path forward remains uncertain. The ongoing negotiations between key players, such as the US, Russia, and Ukraine, will play a crucial role in shaping the future trajectory of oil prices. Stay tuned for further updates on this evolving story.

In conclusion, the oil market is navigating through a period of heightened volatility, driven by a combination of supply concerns and geopolitical tensions. The delicate balance between these factors will determine the direction of oil prices in the coming weeks. As investors and analysts closely monitor the unfolding developments, the resilience of the oil market in the face of multifaceted challenges will be put to the test.