Navigating Inflation and Jobs: Federal Reserve Faces Challenges Ahead

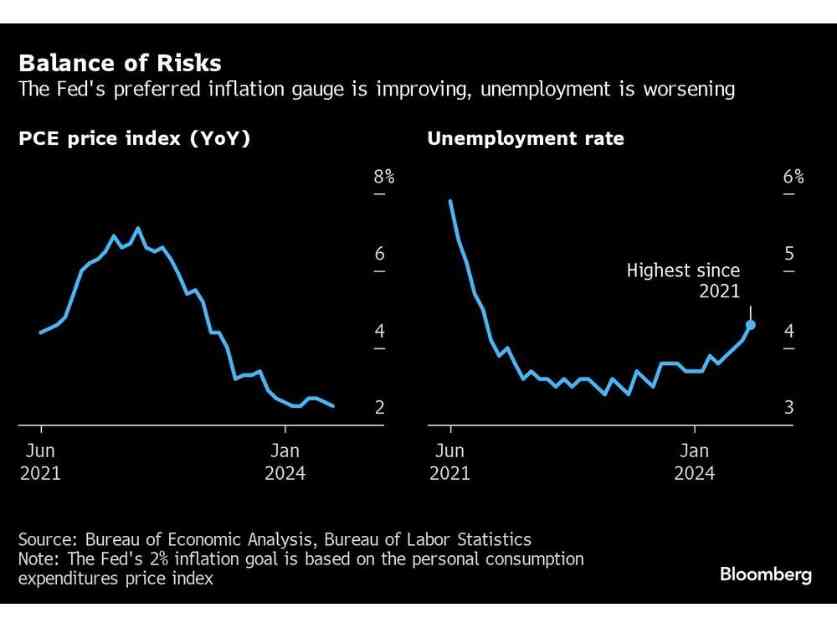

Federal Reserve officials are currently grappling with the complex task of balancing inflation and job market concerns as they consider lowering interest rates. The markets are anticipating a quarter-point cut in the near future, but the Federal Open Market Committee (FOMC) is faced with the challenge of determining the optimal timing and pace of rate adjustments to address these dual risks.

The Fed’s primary goal is to combat inflation while also supporting job growth. This delicate balancing act requires careful consideration and strategic decision-making to prevent a rapid deterioration in the labor market while addressing inflationary pressures.

The Fed’s Strategic Approach

As the Fed contemplates potential rate cuts, economists like Derek Tang emphasize the importance of a long-term strategy to navigate the uncertain economic landscape. The central bank is focused on managing risks effectively, weighing the trade-offs between inflation and employment stability.

FOMC Divisions and Diverging Views

Within the FOMC, there are differing opinions on the urgency of rate cuts. Some officials, like Fed Governor Michelle Bowman and Atlanta Fed President Raphael Bostic, advocate for cautiousness, emphasizing the need for more evidence of sustained price stability and labor market resilience before implementing rate reductions.

On the other hand, officials like San Francisco Fed President Mary Daly are concerned about the slowing job market and the potential risks of a downturn if corrective measures are not taken promptly. The rise in unemployment rates and slowing wage growth underscore the challenges facing the Fed in maintaining economic stability.

Risks and Considerations

The stakes are high for the US economy, with the Fed aiming to achieve a soft landing that avoids a recession while promoting sustainable growth. Fed Chair Jerome Powell recognizes the importance of managing risks effectively to secure a positive economic outcome and uphold the central bank’s credibility.

The Fed’s response to inflationary pressures and job market fluctuations will shape the future trajectory of the economy and influence public sentiment. Powell’s leadership in navigating these challenges will be pivotal in determining the Fed’s role in shaping monetary policy decisions.

In conclusion, the Federal Reserve faces a complex and multifaceted challenge in balancing inflation and job market concerns. The strategic approach adopted by the central bank will play a crucial role in determining the economic outlook and ensuring stability in the face of evolving risks and uncertainties.