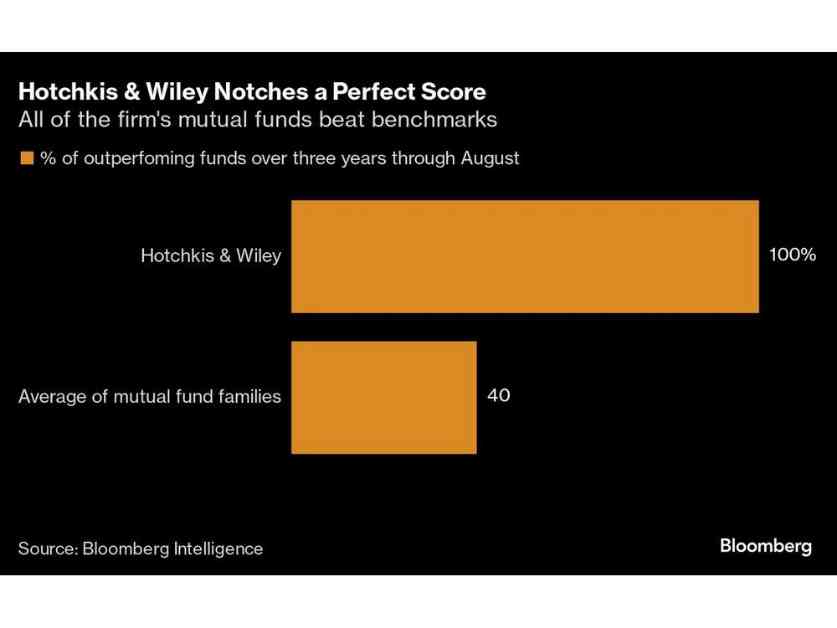

Value investing has been a hot topic of debate lately, with many arguing that it’s become increasingly difficult in today’s market. However, Scott McBride, the fund manager of Hotchkis & Wiley Capital Management, has proven them wrong by achieving a perfect record in stock-picking. All 10 of the firm’s actively managed mutual funds have outperformed their benchmarks over the past three to five years.

McBride’s success goes against the narrative that active management is losing its edge against passive funds. He believes that the very trends that are said to be challenging value investing, such as passive flows into growth stocks and unpredictable investor preferences, actually create opportunities for stock pickers. Despite the high price-earnings ratio of the S&P 500, McBride still sees potential in building portfolios with multiples in line with historical averages.

Hotchkis & Wiley’s remarkable 100% win rate is a testament to their ability to locate outsized returns in the market. While value stocks have struggled overall, several of the firm’s funds have managed to outperform, including the Value Opportunities portfolio, which returned 10% annually over three years.

One key strategy that Hotchkis & Wiley employs is to uncover companies whose fair values are significantly below their market prices based on projected growth. They focus on companies that pay dividends or buy back shares, seeking long-term value rather than chasing short-term trends.

Despite some underperformance this year, McBride remains committed to the firm’s investment philosophy. They are willing to double down on unpopular stocks and have increased their holdings in companies like APA Corp., an energy producer that the market has underestimated.

In terms of sector allocation, Hotchkis & Wiley has a significant exposure to internet and software stocks, which make up 24% of their holdings. McBride defends the seemingly high valuations of these stocks by adjusting for expenses that may impact current profits but could benefit growth in the long run.

One example is Workday Inc., a software company that trades at 40 times earnings. While its profitability is currently under pressure due to increased spending, McBride believes in the company’s long-term potential and sees it as a valuable investment opportunity.

Overall, Hotchkis & Wiley’s success in value investing serves as a reminder that active management can still outperform passive strategies in today’s market. Despite the challenges, there are still opportunities for stock pickers to generate strong returns by focusing on long-term value and staying true to their investment philosophy.