India is making strides in the realm of sustainable finance, with the market regulator aiming to broaden the scope of its ESG (Environmental, Social, and Governance) debt framework. This move could potentially bolster the usage of ESG-labeled instruments in Asia, marking a significant step towards promoting sustainable investing practices in the region.

The Securities and Exchange Board of India is looking to expand the range of products covered under its sustainable finance framework. This expansion may include the introduction of social bonds, sustainable bonds, sustainability-linked bonds, and eligible asset-backed securities. Additionally, there may be a new requirement for independent external reviews of all ESG debt offerings. These proposed changes are part of the regulator’s efforts to encourage the issuance of debt for a broader range of activities that align with environmental, social, and governance principles.

According to Xuan Sheng Ou Yong, sustainable fixed income lead for Asia Pacific at BNP Paribas Asset Management in Singapore, the proposal to introduce new types of ESG debt is a positive development for the market. It opens up opportunities for directing fixed income capital towards a wider range of issuers and projects, beyond the traditional green bonds that focus solely on environmental sustainability.

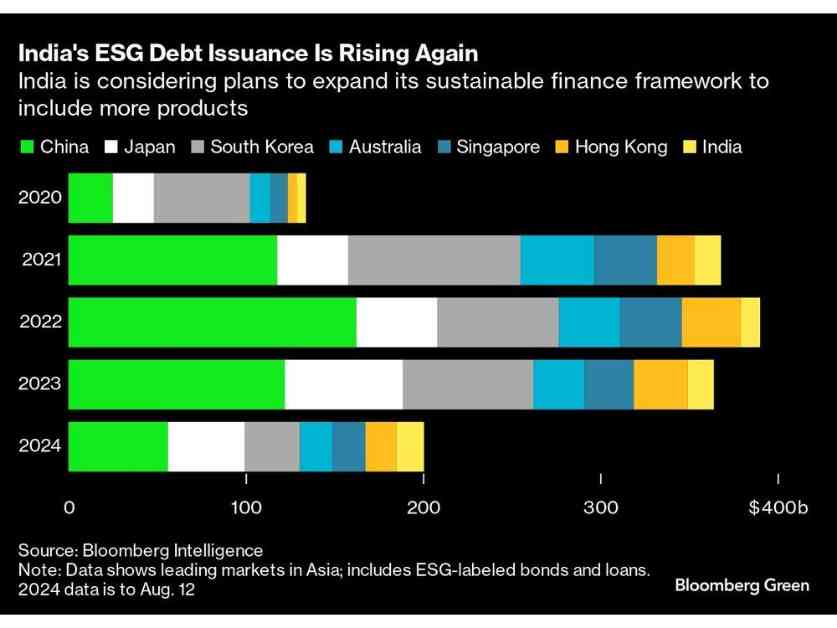

India has seen a significant increase in the issuance of ESG debt this year, with the total reaching $15.6 billion, surpassing the previous annual record set in 2021. Despite this growth, India’s ESG debt volume still lags behind other key markets in Asia, such as China and Japan. The proposed expansion of the sustainable finance framework could potentially attract more issuers and investors to the Indian market, further accelerating the adoption of ESG principles in the country.

The move towards expanding ESG debt in India aligns with Prime Minister Narendra Modi’s commitment to promoting green growth and sustainability. By diversifying the types of ESG-labeled instruments available in the market, India aims to support environmentally and socially responsible projects that contribute to a more sustainable future.

In a global context, the increase in ESG debt issuance in India comes at a crucial time when the overall volume of ESG-labeled bonds has experienced a decline. Sustainable Fitch reported a 33% decrease in the second quarter compared to the same period last year, highlighting the importance of initiatives like the one undertaken by the Securities and Exchange Board of India to stimulate the ESG debt market.

Overall, the proposed expansion of the sustainable finance framework in India represents a significant step towards fostering sustainable investing practices and promoting responsible capital allocation. By broadening the range of ESG-labeled instruments available to investors, India is poised to attract more capital towards projects that have a positive impact on the environment, society, and governance standards.

Implications for the Market

The introduction of new types of ESG debt products in India could have far-reaching implications for the market. By diversifying the range of instruments available to investors, the country may attract a broader investor base interested in sustainable investing. This, in turn, could lead to increased capital flows towards projects that prioritize environmental, social, and governance considerations, ultimately driving positive change in the economy.

Challenges and Opportunities

While the expansion of ESG debt in India presents significant opportunities for growth and sustainability, it also poses certain challenges. One of the key challenges could be ensuring that the new products meet the necessary standards and criteria to qualify as ESG-labeled instruments. Additionally, educating investors about the benefits and risks associated with ESG investing will be crucial to fostering a thriving market for sustainable finance in India.

Future Outlook

As India continues to embrace sustainable finance and expand the scope of its ESG debt framework, the future looks promising for the country’s green finance sector. By encouraging the issuance of a wider range of ESG-labeled instruments and promoting responsible investing practices, India is positioning itself as a leading player in the global sustainable finance landscape. With a strong commitment to green growth and sustainability, India is set to play a pivotal role in shaping the future of ESG investing in the region and beyond.