European Stocks Hit All-Time Highs on Positive Sentiment Surrounding China Trade Deal

European equities reached unprecedented levels as investor confidence in a potential trade deal with China drove a surge in the market. The Stoxx Europe 600 Index closed the trading session with a 1.3% gain, marking a historic high for the region.

Optimism was fueled by reports that China is considering injecting a significant amount of capital into its state-owned banks, amounting to around one trillion yuan ($142 billion). This news boosted sectors closely tied to the Chinese economy, such as luxury goods, mining, automakers, and technology companies.

However, while the overall sentiment was positive, some individual stocks experienced notable declines due to company-specific updates. For instance, Hennes & Mauritz AB saw a sharp drop of 8.6% after announcing that it may not meet its operating margin target for the year due to unfavorable weather conditions in Europe. Similarly, Ubisoft Entertainment SA faced a decline of up to 21% after revising its targets and delaying the release of its next video game.

On the other hand, energy stocks dipped in line with the decrease in Brent crude prices. Despite these fluctuations, European equities have largely remained stable since August, amid concerns about slowing economic growth in the US and Europe.

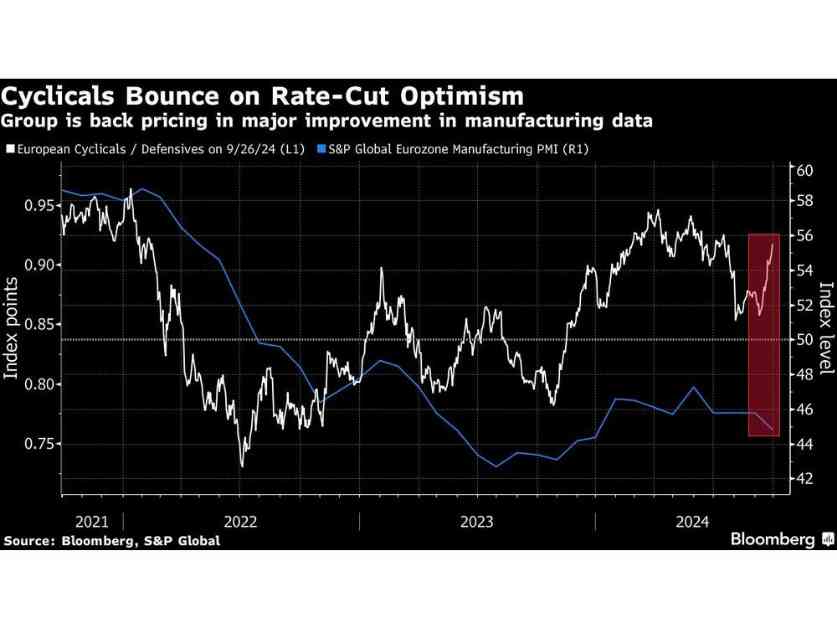

Looking ahead, investors are eyeing potential catalysts that could further drive market performance. Speculation about additional interest rate cuts from central banks, including the European Central Bank and the Federal Reserve, has been mounting. Traders are now anticipating 50 basis points of ECB rate cuts by the end of the year, following a recent rate reduction in Switzerland.

Upcoming events, such as speeches by ECB President Christine Lagarde and Fed Chair Jerome Powell, as well as the upcoming earnings season, could provide additional insights into the market outlook. Analysts are also monitoring the possibility of further rate cuts and their impact on different sectors.

Michael Field, European market strategist at Morningstar, noted that investor sentiment has improved recently, pointing to a brighter outlook for the market. He emphasized the importance of upcoming earnings reports and potential rate cuts in shaping market dynamics.

Overall, European stocks are experiencing a period of heightened optimism, driven by positive developments in the global economy and expectations of further monetary stimulus. The market remains poised for potential growth, with investors closely watching for key indicators and events that could impact future performance.

Key Takeaways:

– European equities reached record highs on the back of positive sentiment surrounding a potential trade deal with China.

– Sectors exposed to the Chinese economy, including luxury goods, mining, automakers, and technology companies, led the market rally.

– Despite overall gains, some individual stocks experienced declines due to company-specific updates.

– Energy stocks mirrored the drop in Brent crude prices, contributing to fluctuations in the market.

– Investors are anticipating further interest rate cuts from central banks, which could serve as catalysts for market growth.

– Upcoming events, such as speeches by central bank officials and the earnings season, are expected to provide further insights into market trends.

– Analysts remain optimistic about the market outlook, citing improved investor sentiment and potential for growth.

In conclusion, European stocks are riding high on the wave of positive news surrounding the China trade deal and monetary stimulus measures. With key events on the horizon, the market is poised for continued growth and stability in the coming months.